Category: candlestick patterns

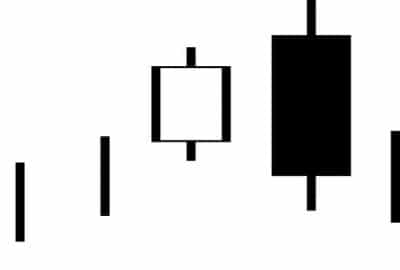

Bullish abandoned baby candlestick pattern is often observed when the market is ready for drastic reversal. It is very easy to recognize. First, the market is taking a generally …

Are you waiting for a stock to hit rock bottom? If so, you should be watching for the three outside down candlestick pattern. This formation is a reversal signal …

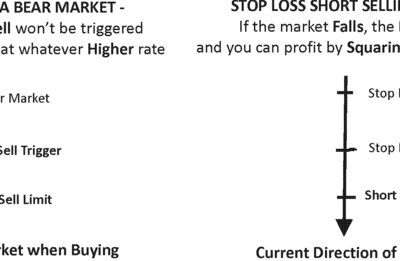

A stop-loss indicator is simply a price level at which traders should sell stock to prevent loss and maximize profit. This indicator varies from market to market and even …

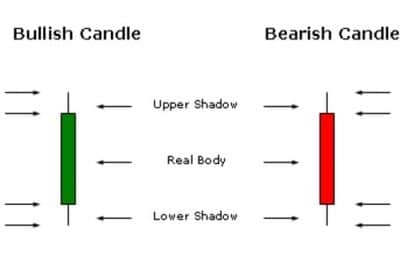

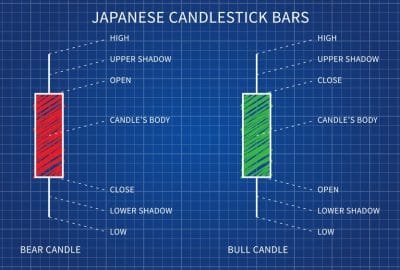

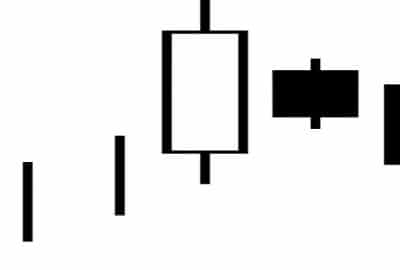

A typical candlestick is made up of a parts: the body and the shadow. A candlestick shows us a price bar with an opening price, a closing price, a …

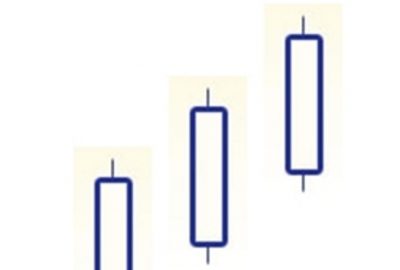

The three white soldiers candlestick pattern is an unusual one because its significance depends on its context. However, the pattern itself is easy enough to recognize. This formation simply …

Reading Bars Reading bars is one of the most popular methods of charting and financial market analysis, second only to candlestick charting. This method is popular because the simple …

If you are trading or thinking of getting into trading, Technical Analysis or TA is a very important part of the process. With out looking into Technical Analysis and …

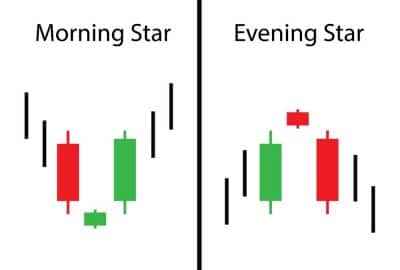

Are you getting tired of a downtrending market? Are you wondering when it is going to end? If so, the morning star candlestick pattern is one formation to watch …

The three outside down candlestick pattern occurs during a bullish market. It begins with a short white candlestick on day one, but the second day comes with a surprise. …

The three inside down candlestick pattern signals the end of one trend and the beginning of another. The movement that is about to end is a bullish uptrend that …