It’s possible to take rules from technical and fundamental analysis and put them together to produce highly effective stock market methods. Two of the best champions of this approach are William J. O’Neil and Martin Zweig, whose methods have trounced the market over significant time frames. O’Neil and Zweig’s methods have some strong similarities, but are by no means identical. Both are very successful, hence they provide an excellent starting point for stock market newbies.

O’Neil explained his CANSLIM method in How to Make Money in Stocks.

Zweig explained his market-beating method in Winning on Wall Street.

The O’Neill Approach – CANSLIM

The Approach is based on:

- Current Quarterly Earnings per share. This number is taken from the company’s most recent financial results. The higher the most recent quarterly EPS, the better. Ideally it should be the highest in the company’s history. (Fundamental.)

- Annual Earnings Increases: Significant growth is required from year to year. We’re talking about increases over 20% a year for a few years. (Fundamental.)

- New Products, New Management, New Highs: Buy at a time that enables you to take advantage of some positive news. New management might be getting positive media coverage or a new product like Apple’s iPhone might have been launched. New highs could be appearing in the stock’s price chart. (Fundamental and/or Technical.)

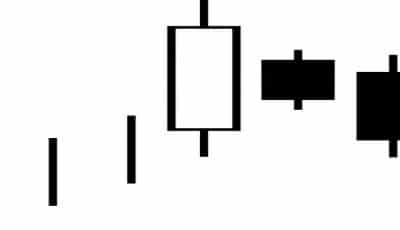

- Supply and Demand: The shares should be in demand with a larger pool of potential buyers than potential sellers. (Technical.)

- Leader or Laggard: Buy the leading stock in any sector (the one whose price is advancing fastest) and avoid the laggards. (Technical.)

- Institutional Sponsorship: Are the big boys buying? (Technical.)

- Market Direction: Buy when the market is in an uptrend. (Technical.)

The Zweig Approach

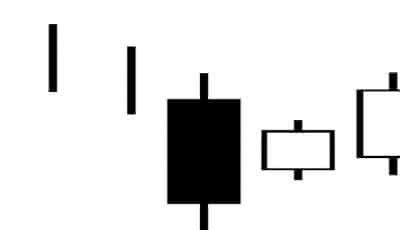

Martin Zweig’s investing strategy is to buy and sell stocks in line with monetary conditions (a fundamental approach), the direction of the stock market (a technical approach), and the performance (both fundamental and technical) of individual stocks.

Zweig’s method brings together several components:

- Fundamental analysis of monetary conditions. The main indicators used are interest rates and debt levels.

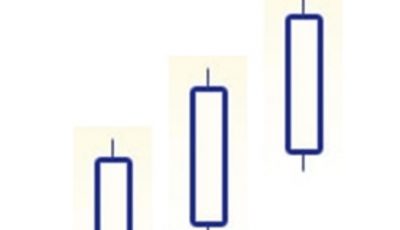

- Technical analysis of the stock market as a whole, to measure market momentum. The three indicators used are the Advance/Decline ratio, Up Volume, and The Four Percent Indicator.

- The Super Model, where the other indicators are added to yield a total score. The Super Model tells Zweigh whether the broad market is likely to be bullish or bearish.

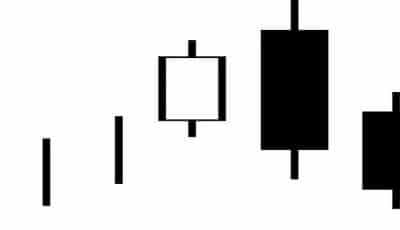

If the Super Model indicates bullish conditions, Zweig believes investors should allocate their maximum funds to buying stocks. Individual stocks are chosen as follows:

- Stocks are screened for superior fundamentals – in particular, above average earnings growth and a reasonable price/earnings ratio.

- Stocks whose fundamentals look attractive are screened using basic technical analysis. Only stocks whose price action shows strength are selected.

Fundamental or Technical Analysis

To judge the market as a whole, Zweig gives greater weight to technical analysis than fundamental analysis. To judge individual stocks, he gives greater weight to fundamental analysis than technical analysis.

A Summary of Martin Zweig’s Market Strategy

The basis of Martin Zweig’s investment philosophy is to take a measure of whether the broader market is bearish or bullish and then stay in tune with it. If the market is bullish, buy attractive stocks and let your profits run. Lock in profits or cut your losses by selling according to pre-established criteria. If the market is bearish, stand on the sidelines with cash, waiting to enter the market when it turns bullish.