Algorithmic Trading has taken the domain of trading into the next generation. It is bringing several opportunities for traders. It is said to increase horizons to achieve optimum results from trading activities. It helps efficiently implements trading orders and eliminates biases.

According to PR Newswire “The global algorithmic trading market size was valued at USD 12,143 Million in 2020 and is projected to reach USD 31,494 Million by 2028, registering a CAGR of 12.7% from 2021 to 2028.”

This article discusses:

- What is Algorithmic Trading?

- How does Algorithmic Trading Work?

- Who uses Algorithms in Trading Activities?

- What are the Advantages of Algorithmic Trading?

- Technical Prerequisites to Execute Algorithmic Trading Strategies

- What are the Steps to building Algorithmic Trading Strategies?

- What are the most common Algorithmic Trading Strategies?

- Future of Algorithmic Trading: What to Expect?

What is Algorithmic Trading?

Several advancements in technology are revolutionizing multiple industries. Algorithmic Trading is a great example of this revolution in the stock market. Algorithms or algos are computer commands that help implement tasks. Multiple factors often impact financial Market changes and dynamics.

Traders require a robust solution that helps them mechanize their activities to procure optimum results. Therefore, Algorithmic Trading offers approaches to develop models that systematically analyse parameters and provide insights.

Algorithms also help build models that execute strategies for more efficient results. The models help evaluate data regarding multiple assets and markets. Algorithmic trading enables traders to eliminate emotional and psychological biases to make fact-based decisions.

How does it work?

Algorithmic trading uses coded instructions and commands built using algorithms. The models developed use algorithms to automate trading activities and execute various strategies. It also considers various factors like price, quantity, sentiments, technical aspects, innovations, etc. to procure insights.

One of the most pivotal functions in Algo trading is to determine the right strategy. It enables traders to backtest strategies and the impact certain market conditions have on them. The use of mathematical models enables traders to analyse large data sets. Algorithmic trading uses multiple solutions to comprehend and forecast market trends to develop strategies.

Algo trading leverages solutions to monitor and track various trading activities across markets. Algorithms help develop fact-based strategies to determine risks and opportunities. Hence, it helps train and develop models to exit trades during critical conditions.

Who uses Algorithms in Trading Activities?

Algorithms in trading enable traders to leverage the advancements to systematically execute activities. Algorithms offer innovation using mathematical and statistical models to analyse parameters across markets. As a result, algorithmic trading can be leveraged by

- Mid to Long-Term Investors

They work with pensions, mutual funds, insurance, etc. also known as buy-side investors who buy and sell assets in huge quantities. Algorithms automate trading tasks and build strategies for the financial market.

- Short-Term Traders

Also known as sell-side traders are often the market makers who identify opportunities to procure optimum results. The group includes market makers, speculators, and arbitrageurs who use algorithms to automate multiple activities.

- Systematic Traders

The trader often seeks opportunities in market trends, hedge funds, and pair trading using a systematic approach. They manage strategies to automate trading activities using trained models.

What are the advantages of Algo Trading?

Algorithmic Trading offers several advantages to traders to automate the implementation of activities. It efficiently executes tasks within a shorter period. The following are some of the key advantages of Algo Trading:

● Elimination of Biases

Algo trading automates multiple activities and one of its pivotal advantages is eliminating emotional and psychological biases. That is to say, it uses large data sets to develop fact-based insights. It mitigates implementing activities on the biases to avoid irrational decisions. It leverages automation to execute trades and limits human intervention.

● Accuracy and Speed in Trading

While eliminating biases and making decisions based on factual data, Algo trading offers accuracy. It automatically executes tasks according to accurate and calculated timings to gain optimum results. It develops and trains models under sets of instructions to reduce the scope of errors or bottlenecks.

Moreover, models developed with the set of instructions automate multiple tasks. It also enables traders to participate across markets and trade multiple assets at higher speed and accuracy. Therefore, it increases opportunities for traders to gain optimum results.

● Backtesting Strategies

There are multiple strategies that traders can use across multiple markets. Although traders require to test certain strategies under market conditions. It is pivotal to know if the strategy is favourable or requires development to execute activities. Therefore, Backtesting becomes an important advantage in Algorithmic Trading.

Traders can use this ability to determine the health of a strategy in a given market. Backtesting uses historical data for the strategies and traders can compare the outcomes to current market scenarios.

● Reduce Transaction Costs

Advancements in trading technology have led the industry to experience various changes. Algorithms in trading have played a critical role in reducing transaction costs. Algorithms develop models that help save time, costs, and effort for traders.

● Trading Multiple Assets

Algo trading helps manage and automate several trading activities. The mathematical models analyse the data to gain optimum results. Traders can leverage this advantage to trade multiple assets across several markets.

Technical Prerequisites to Execute Algorithmic Trading Strategies

Some technical prerequisites that impact trading strategies that traders must know :

- Algorithmic trading deals with developing algorithms and models to execute trading activities. Hence, it is critical to understand or gain knowledge of technical components like programming languages.

- Since algorithmic trading is an advanced concept, traders need to procure strong networks to execute activities on multiple platforms.

- It is also critical to gather data and market insights to help with backtesting and determining trading opportunities.

- Traders need a comprehensive understanding of strategies to develop them for actual market scenarios.

What are the Steps to building Algorithmic Trading Strategies?

The following steps are essential towards building your Algorithmic Trading strategies:

- Traders must determine a trading strategy according to their requirements and desired results. It helps understand the opportunities various strategies can create.

- It is critical to statistically analyse the strategy that would help trade the asset.

- Algorithms are an essential aspect, therefore, it is pivotal to develop codes that define logic in trades using programming languages like Python, R, C++ etc.

- It is also important to develop models that are trained under specific instructions. The passive or aggressive manner of trading must depend on the market conditions.

- Backtesting is a pivotal step that evaluates and analyses the performance of a strategy. However, it uses historical data as a component to understand the potential of the strategy.

- Traders must consider the consequences of risks while implementing strategies. Factors like CAGR, hit ratio, Sharpe ratio etc. can change the course of results.

What are the most common Algorithmic Trading Strategies?

Algorithmic Trading brings in several innovations and opportunities in the trading domain. Traders can utilise multiple strategies developed in algorithmic trading to procure maximum benefits. Here are a few common strategies in Algo Trading:

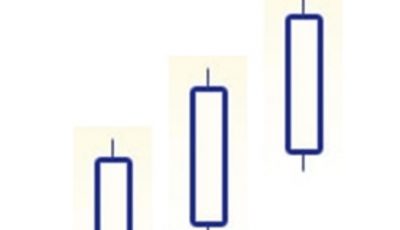

- Trend-Following Strategy

- Arbitrage

- Index-Fund Rebalancing

- Quantitative Trading Strategies

- Mean Reversion Strategy

- Volume-Weighted Average Price (VWAP)

The future of Algorithmic Trading: What to Expect?

Algorithmic trading broadens the horizons for traders and the domain. It is a great opportunity that enhances trading activities to efficiently procure optimum results. Further, algorithms enable a systematized technique in trading and reduce any influence that may affect the results. It efficiently automates task execution to offer accuracy.

Algo Trading is an evolving concept. Traders are leveraging its benefits to gain optimum results. Moreover, the use of algorithms offers traders to develop innovative strategies and models.

Next steps in Algo Trading Algo Trading is an advancing domain that is expanding horizons for traders, developers, working professionals etc. Individuals can indulge in an Algorithmic Trading Course to leverage mentorship and advanced resources to become successful traders. Algorithmic trading can create various opportunities in trading and the automation of tasks.