To learn stock market basics is what a wise person does before committing their money to the stock market.

There is no doubt that the stock markets are a great way to make money when you look at the longer term. There are winners and losers in investing and, of course you want to be among the winners, don’t you?

The winners generally understand the basics of investing in the stock market the losers do not! There are exceptions such as someone who hasn’t invested before taking a shine to a stock and making a killing.

That is the exception not the rule.

The reason that lots of investors lose money is that they plunge into the market without understanding how the stock market works. They do not learn stock basics.

They haven’t taken the time to learn stock market basics.

Ignorance of investing creates bubbles that burst.

A stock market bubble takes place when investors drive stock prices above their true value in relation to balanced stock valuation because of greed or the fear of missing out on, so called, certain gains. This is commonly called herd behavior.

I remember trading during the stock market crash of 1987 (also known as Black Monday) which was the largest one-day market crash in history. It was chaos with trading being shut down and some hefty losses being made.

Those who had not taken the time to learn stock market basics full of panic sold when they could at the bottom. Those who had taken the time to learn stock market basics held on to see values return and grow in a relatively short space of time.

The Crash of 1987 brought to an end a spectacular bull market run that started in 1982 that was fueled by a supercharged business environment involving hostile takeovers, leveraged buyouts and merger mania.

The Dow index almost doubled from 1986 until the autumn of 1987, when the market began to drop. On Monday October 19th, 1987, an avalanche of very aggressive “sell” orders hit the market as investors began to panic, which triggered additional “sell” orders and more use of portfolio insurance. By the end of that day, Black Monday, the Dow lost an incredible 22.6% of its value. A great way to learn stock can go down as well as up.But things recovered and people continued to make money.

The Dot-com Bubble was another speculative bubble in the shares of early internet companies called “Dot-coms.” From the mid to late-1990s, technology company stocks in the Nasdaq stock index soared to incredible heights, driven by a mass pursuit of easy money on a sure thing. Many investors began to believe that technology had led to the emergence of a “New Kind Of Investment” that was completely different to the traditional way of investing and the only way was up.

It couldn’t fail.

Those who had taken time to learn stock market basics knew better.

Nevertheless, this false herd belief led to excessive risk-taking from investors, urged on by brokers looking for excessive profits. As more and more dotcom companies went public (such as the infamous Pets.com and Webvan) showing negative earnings or astronomically high business valuations. There were willing investors willing to buy hyped up shares. It all came to an end as bubbles always do in early 2000, when the dot com stock bubble crashed spectacularly with the Nasdaq plunging from 5,000 to nearly 1,000 by 2002.

How do you protect yourself as an investor from these types of falls.

You learn stock market basics before you invest in the market. Any time or money invested in this will pay you great dividends in the future and protect you from foolish investments in bubbles.

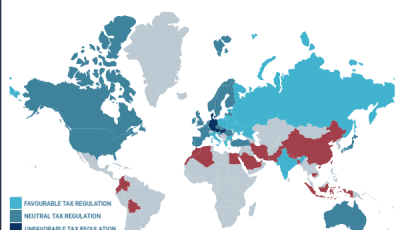

There are also some free places where you can actually get some helpful knowledge about stock market basics as well as the terminology used by investors. One of the best places to start is the stock exchanges sites of the country you want to invest in such as nseindia or bseindia. These have great introductions that will help you to learn stock market basics.

Another practical way is to buy some beginner’s books and then study them thoroughly.

Another way to learn is to join some stock market game or virtual trading test where you can learn the theory of profitable investing.

But perhaps the best way to learn the stock market is to purchase a video training course that will help you gain the understanding of a real stock market trading system as a trader.