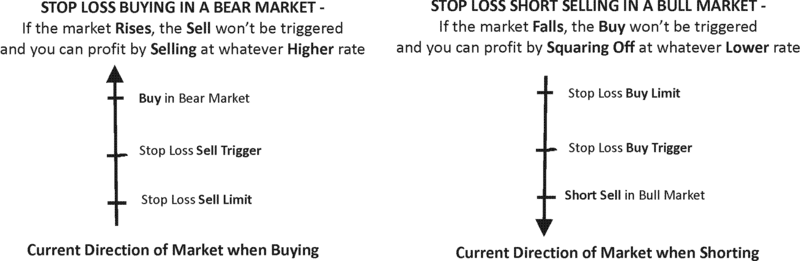

A stop-loss indicator is simply a price level at which traders should sell stock to prevent loss and maximize profit. This indicator varies from market to market and even between long and short positions. Most stop-loss indicators have what is called a ratchet mechanism, which allows the stop-loss level to move ever higher to protect any earnings.

There are several ways of calculating a stop-loss indicator, but the most common is to calculate the average range of a given market then multiply it by a factor developed from the stock’s previous highs. The ratchet mechanism is integrated into this number so that it changes from day to day, getting higher as the stock’s value rises. The ratchet mechanism also can lower the stop-loss indicator if the stock is gradually losing value, allowing short position traders to protect gains.

The stop-loss indicator is valuable because it allows traders to set a threshold below which they will liquidate their stock. This takes a lot of guessing out of the job of analysis and trading. The ratchet mechanism moves the stop-loss indicator up and down so that the threshold changes with the market conditions and fluctuations.

One important thing to know about stop-loss indicators is that they are indicators, not mandates. Traders may decide to liquidate assets before the price reaches the low of the indicator; conversely, they may decide to hold on to a particular stock even if it dips below the threshold denoted by the indicator. The stock market is a complicated market, so stock analysts look at a variety of factors when making important decisions.