What is Algo Trading with Zerodha Streak ?

Streak is an PAID platform provided by Zerodha to develop and back test your own strategies based on technical analysis indicators.

Do they have FREE plan ?

No. But if you are new user you can use this link to get 7 days free trial. Also you get 150 points free, which you can use it to get 1 month plan if you refer 1 more person using their referral plan. ie.300 points needed to get 1 month free plan.

https://ref.streak.tech/J2UcyHfUvfxoSooJ8

What is the Zerodha Streak Platform Cost ?

Their Monthly Regular Plan costs Rs.814.20 (including GST) and Ultimate Plan costs Rs.1,652 (including GST). You will get discounts if you choose to pay for them quarterly or half yearly or yearly. Also they will have some offers going on during festivals season for long term plans.

Can I do automated trading with zerodha streak ?

No. You CANNOT DO AUTOMATED TRADING with Zerodha Streak. It is a kind of semi automated or alert system. You will get notification in your mobile, email and inside your streak account. If you choose to act on it, trade order will be placed, else nothing happens. Please be aware of the Rs.59/- square off charges by zerodha, if you do not square off your intraday positions before 3:15 PM.

Pros :

You need not manually scan and monitor all the stocks for trading opportunity. Whatever stocks matching your selection criteria from your strategies match the required condition, you will get notification to enter the trade.

Cons :

The real drawback of streak is, you have to control your trading through streak login only. You CANNOT set STOP LOSS order within streak, you will have to monitor the stocks which you have bought/sold and manually initiate square off when stop loss / target is reached or if you decide the profit / loss for that trade is sufficient.

What are the Brokers Supported by Zerodha Streak

- Zerodha

- Angel One

- 5 Paisa

- Upstox

- ICICdirect

How to make use of Zerodha Streak if you are trading using any other brokers for your trading ?

Unfortunately there is no direct way for that. But you can always open your account with Zerodha through this link and sign up for streak. Then setup paper trading for your strategies in streak, whenever you get notifications for paper trading initiation, you can do the same trading in your own brokerage account. Note : Please test for time delay (if any) between paper trading notifications and real trading stock trades at that time before you make actual tradings based on that.

It will cost you one more AMC in Zerodha, if you prefer to trade with other brokers.

Can any one without technical coding experience can setup algo in Streak ?

Yes. You can make use of their Help and Academy sections to learn new technical indicators and implement or test while creating your own strategies in Streak.

What % ROI is good to start trading with real money ?

There is NO direct answer for this question. It depends based on the number of trades initiated, number of profitable trades, number of failed trades, what is the P&L generated before and after brokerage etc. Even if 20% ROI is achieved it is of no use if the P&L after brokerage is in NEGATIVE, but even 5% may be very good if it is the P&L AFTER ADJUSTING FOR BROKERAGE FEES.

How to Setup Manual Stop loss and Target while using Streak ?

Instead of initiating trade directly from streak when you get live trading signal, go to your Zerodha Kite account, add the scrip, place manual MIS order with both Stop loss and Target so that you need not manually track your position for each stock. However you need to square off your Intraday positions before 3:15 pm else zerodha will charge you Rs.59/- for square off charges.

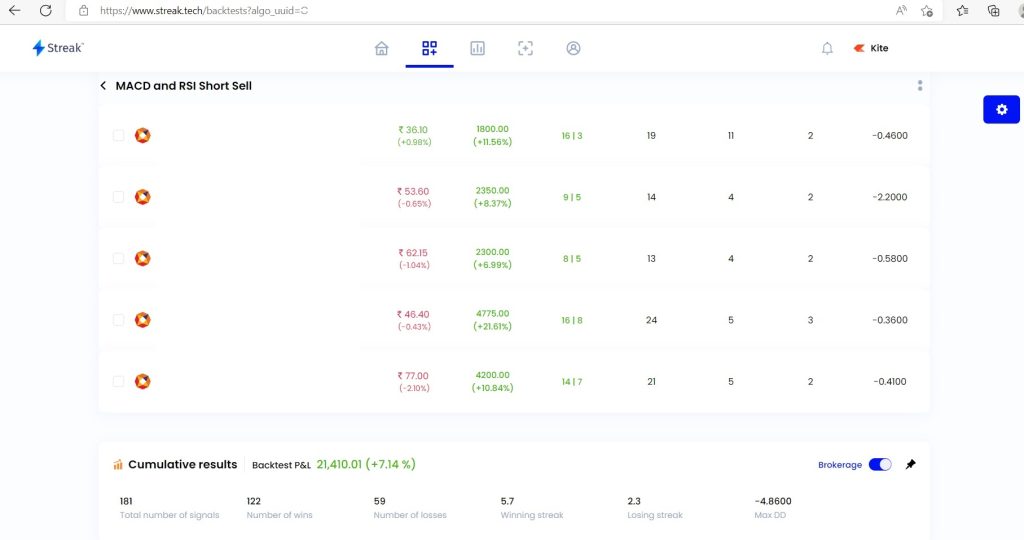

Sample Strategy Results using MACD and RSI (INTRADAY TRADING for 3 months)

Rs.21,410 /181 Trades = Rs.118 profit per trade after brokerage (including failed or loss making trades).

Please note that it is BACK TEST results for specif time period, the results will change when you change the period and there will be difference between back test, paper trades and real trading based on many other factors. Ex: MARKET RATE / LIMIT fixed by you at that time and actual position you got at that rate etc.

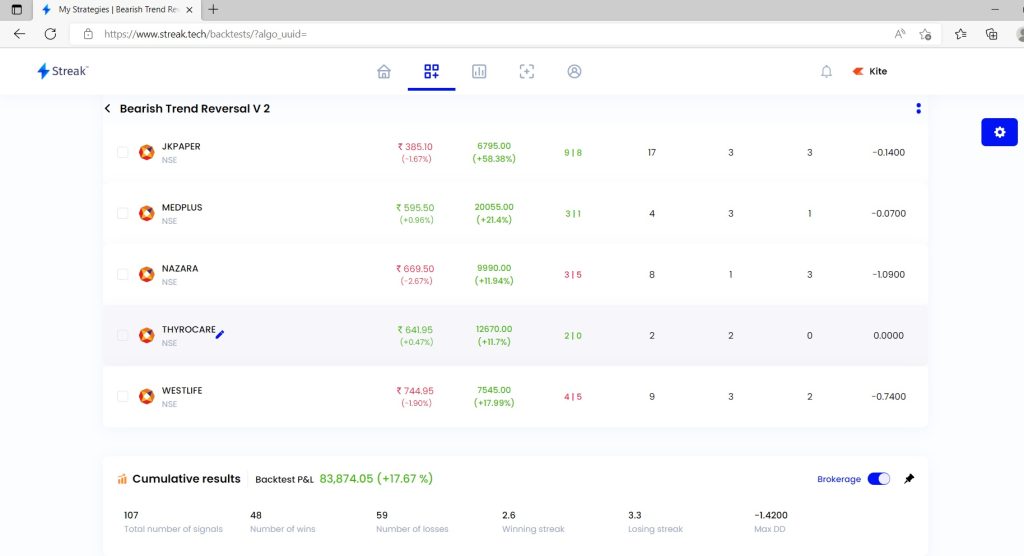

Delivery Based Bearish Trend Reversal Strategy Results (3 months)

If you see the below results, you will be wondering how our ROI is POSITIVE despite more loosing trades than the winning trades, the reason is simple Stop loss at 2% and Target Profit at 8%. As you can see JKPAPER had only 9 profitable trades with 8% target = 72% – 16% = 56% profit. For over 107 trades the net profit after brokerage is Rs.83,874.05 ie. Average profit of Rs.783 per trade including the failed trades.

So the ROI and actual profit should be the aim, not the % of success alone. If you setup you own strategies for any scrips for most commonly used methods you will hardly see 2% or 3% ROI after brokerage. ALWAYS ENABLE THE BROKERAGE button at bottom to see the ROI AFTER BROKERAGE otherwise it will be misleading information for you.

Frequently Asked Questions :

Whether all the methods will work for all the scrips ?

No, NEVER. The same logic which I have set for the above stocks will fail miserably for other stocks. Test, Re-test, optimize is the way to go. You can test your strategy with 50 stocks at a time and you are allowed to do up to 300 back tests a day with REGULAR plan. So eliminate all the loss making scrips and the scrips with ROI less than 5% etc based on your requirements.

Why the same strategy with good results not working in paper trading or real market ?

Because market involves various factors and THERE IS NO GUARANTEED METHOD available with any one to book only profits with all the trades. The success depends the overall +VE ROI arrived from multiple trades on daily, weekly and monthly basis. Never limit your strategy with a single stock, always diversify with at least 5 different scrips with good ROI on each of your strategy.

What is the IDEAL ROI% to expect !

I Really cannot answer this myself. Greed and Fear are amazing emotions, Greed will ask for more when you start to book profits regularly. Fear will ask you to quit the market after few failed trades. How much ROI is enough should be best decided by yourself. A Range of 5% to 10% within 3 months may be reasonable (which is still way better the Bank ROI) but expecting like 20% or more every month is IMPOSSIBLE (at least for more than 99.9% of the traders). Never forget that YOUR MONEY IN MARKET IS ALWAYS AT RISK and never safe like being in Bank Deposit or Cash in your Locker, be always aware of the same. INVEST ONLY WHAT YOU CAN AFFORD TO LOOSE.

What is the IDEAL amount to Invest for Intraday

At least Rs.50,000/- would be needed to see some sort of daily earnings with around 2 to 10 trades a day. If you cannot afford that much even Rs.20,000/- might help but be aware not much margin will be available for multiple trades for that amount and thus limits your profitable trades potential and also increase the risk of more failures as only few traders per day are possible. NEVER TAKE ANY STRATEGY DIRECTLY LIVE IRRESPECTIVE OF THE ROI you see in back test results. TEST THEM IN PAPER TRADING FOR AT LEAST 5 TRADING DAYS BEFORE TAKING THE STRATEGY TO LIVE AND TRADE WITH REAL MONEY.

What are the RISKS in Algo Trading ?

- Same scrip, same strategy and same algo will work differently in different market trends. ie. Bullish, Bearish or Sideways market. So back test your strategies for 3 different market trend periods to test it out.

- Bearish Trends are more powerful than Bullish Trends. Fall can be sudden, but recovery will take time, especially true for delivery based trading.

- Even if you do short trading by selling first, there are chances of stocks reaching its upper freeze level like 5% or 10% within first 15 minutes, so always start trading after 9:30 AM only, if possible after 9:45 AM only. In Intraday trading 5% loss converts into 25% capital loss and 10% loss converts to 50% capital loss, so be aware of the same.

- Not all the scrips are allowed for MIS trading in Zerodha. Don’t get carried away with amazing ROI shown in streak, it is of no use, if they do not have 5x margin in zerodha.

- Algo trading discounts all the news, sentiments, emotions, events etc, so you need to avoid the scrips which are having events on that day like results, merger etc for live trading.

- There might be a streak of loss making days if the market trend is extremely bullish or bearish, choose to avoid trading on those days or be ready to bear those losses and hope to recover it on subsequent period.

If you find this blog post helpful please share us your feedback or comments as it will help us to know what traders want and enable us to plan our future posts accordingly.

Chandran N

Thank you