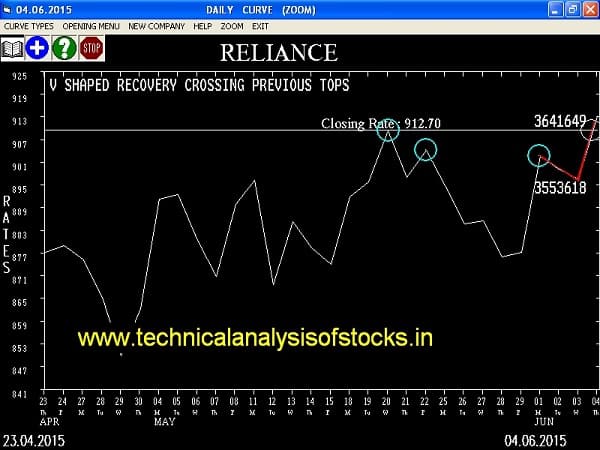

BUY RELIANCE (NSE Code) SIGNAL : V SHAPED RECOVERY CROSSING PREVIOUS TOPS. Stop Loss : 890 Target : 930 (Short term)

| STOCKS TO BUY FOR INTRADAY | |||||||

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT/ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| BEML | 1135.95 | 1139.06 | 1130.64 | 1146.94 | 1155.42 | 1163.93 | 1172.48 |

| JAGRAN | 123.05 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| ONMOBILE | 82.25 | 83.27 | 81.00 | 85.52 | 87.85 | 90.20 | 92.59 |

| POLARIS | 184.15 | 185.64 | 182.25 | 188.97 | 192.42 | 195.90 | 199.42 |

| UPL | 560.50 | 564.06 | 558.14 | 569.73 | 575.71 | 581.72 | 587.77 |

| STOCKS TO SELL IN DAYTRADING | |||||||

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELLAT/BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| RUPA | 376.15 | 375.39 | 380.25 | 370.75 | 365.95 | 361.18 | 356.44 |

| SAIL | 62.25 | 62.02 | 64.00 | 60.09 | 58.17 | 56.28 | 54.42 |

| BANKINDIA | 183.00 | 182.25 | 185.64 | 178.98 | 175.65 | 172.35 | 169.08 |

| SPARC | 368.60 | 365.77 | 370.56 | 361.18 | 356.44 | 351.74 | 347.06 |

| CEATLTD | 701.40 | 695.64 | 702.25 | 689.41 | 682.86 | 676.34 | 669.85 |

sudhendra

Dear Respected Sir,

I had been trading on most of ur call as ur calls are based on technical analysis however failed to make money but lost on Onmobile (holding position), UPL and Jagran all these where Buy , Could make profit in polaris ( to my bad luck ur call on BEML I did not trade.

Ur sell case on SPARC, BOI, RUPA, SAIL lot hugely . I should entered in CEAT than I could made some money but then I did not have the same.

Sir looking for few correct leads please

Supraja Lakshmi

Hi Sudhendra, We always provide our tips based on Technical Analysis only and we cannot control the external factors reflecting in stock market. Please enter in to the trade only after watching the market sentiment and momentum, blindly trading on everything is NOT going to bring you profits. We have provided detailed instructions for both intraday as well as short term recommendation in the respective pages (please view them from your desktop computer as they will not show in mobile version of our site).

As a rule never invest the amount which you cannot afford to lose in stock market. Never exceed 10% of your total capital value in stock market and out of that never more than 10% in any single stock. Diversification and discipline is very important to make money in stock market. Also you should never ignore the STOP LOSS, it is there for a reason.ie. to stop further losses. Your emotional sentiments with some stocks will not help.

If you are interested in stocks which you can hold for long term like few years please consult an fundamental analyst as technical analysis will suit only for short term and day trading.

We wish you for profitable trading days ahead.

pp jain

Excellent tips pp jain

Supraja Lakshmi

Thanks for your appreciation.