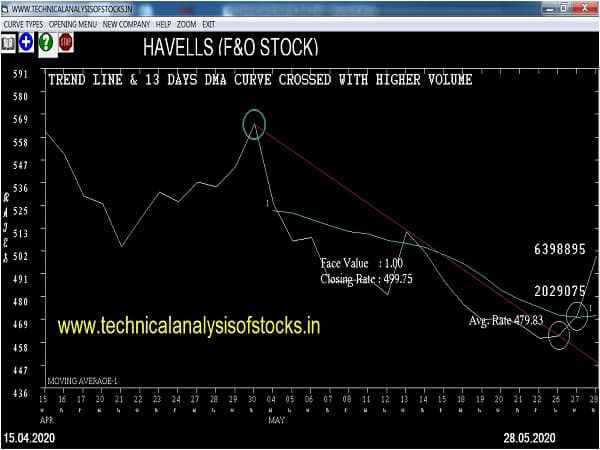

BUY HAVELLS (NSE Code) Buy above 501 after cooling period. SIGNAL : TREND LINE & 13 DAYS DMA CURVE CROSSED WITH HIGHER VOLUME. Stop Loss : 480 Target : 525 (Short term)

HOT BUZZING STOCKS (29.05.2020)

NSE SYMBOL CLOSING RATE

ESABINDIA 1310.10

EIHOTEL 64.65

HINDOILEXP 50.90

DELTACORP 86.10

FRETAIL 80.90

SPANDANA 463.40

VENKEYS 1034.55

ATULAUTO 163.15

BOMDYEING 47.30

FINCABLES 206.35

BFUTILITIE 147.55

CAMLINFINE 40.05

FLFL 145.50

NELCO 174.00

FSC 128.95

SHARDACROP 150.90

JMCPROJECT 42.30

IBVENTURES 73.10

REFEX 50.85

MAHINDCIE 89.15

Strategy : INSIDE CANDLES

ORIENTELEC Buy above @ 169 or above

TORNTPOWER (F&O) Buy above @ 3181 or above

TATACONSUM (F&O) Buy above @ 376 or above

HCG Sell @ 99 or below

CASTROLIND Sell @ 111.50 or below

CIPLA (F&O) Sell @ 624 or below

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

IEX

LTI

WOCKPHARMA

Strategy : GARTLEY SIGNAL (W & M Patterns) (INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

FOR THE ATTENTION OF SWING TRADERS

BUY RECOMMENDATION IF THE MARKET IS BULLISH

ADANIGREEN

SUNPHARMA (F&O)

SELL RECOMMENDATION IF THE MARKET IS BEARISH

DABUR (F&O)

HEROMOTOCO (F&O)

INFY (F&O)

MFSL (F&O)

SRF (F&O)

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| INFY (F&O) | 707.40 | 708.89 | 702.25 | 715.20 | 721.90 | 728.64 | 735.40 |

| TECHM (F&O) | 529.70 | 534.77 | 529.00 | 540.29 | 546.12 | 551.97 | 557.86 |

| BAJAJ-AUTO (F&O) | 2600.00 | 2601.00 | 2588.27 | 2612.46 | 2625.25 | 2638.07 | 2650.92 |

| OMAXE | 176.75 | 178.89 | 175.56 | 182.16 | 185.55 | 188.97 | 192.42 |

| MITTAL | 131.40 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| DEEPAKNTR | 506.00 | 500.64 | 506.25 | 495.31 | 489.76 | 484.24 | 478.75 |

| AXISBANK (F&O) | 390.95 | 390.06 | 395.02 | 385.33 | 380.44 | 375.58 | 370.75 |

| ABB | 739.85 | 735.77 | 742.56 | 729.36 | 722.63 | 715.92 | 709.25 |

| ADANIGAS | 114.85 | 112.89 | 115.56 | 110.31 | 107.69 | 105.12 | 102.57 |

| BALAMINES | 408.55 | 405.02 | 410.06 | 400.20 | 395.21 | 390.26 | 385.33 |