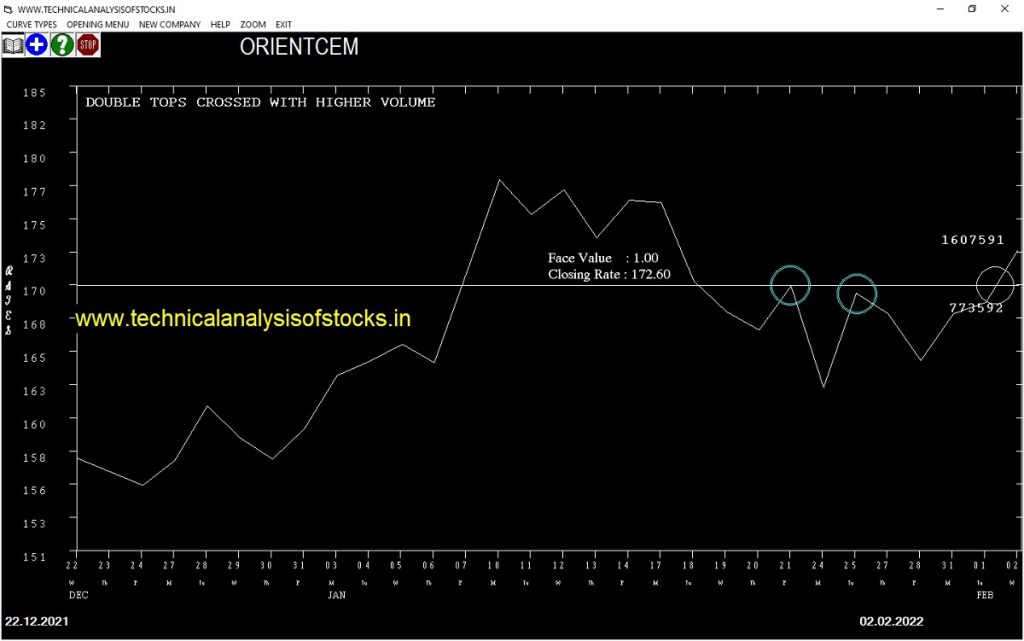

BUY ORIENTCEM (NSE Symbol) Buy 175.55 or Above after cooling period. SIGNAL : DOUBLE TOPS CROSSED WITH HIGHER VOLUME. Stop Loss : 159.50 Target : 189 (Short term)

HOT BUZZING STOCKS (03.02.2022)

NSE SYMBOL CLOSING RATE

NAHARCAP 500.10

TRIL 40.80

JINDRILL 179.50

NAHARPOLY 402.70

SPANDANA 404.50

KDDL 1090.95

ARIHANTCAP 301.60

TRIGYN 190.10

BRNL 54.35

JINDALPHOT 316.25

KELLTONTEC 106.10

AJMERA 480.40

AURIONPRO 328.10

DSSL 238.65

FILATEX 122.00

IIFL 346.05

KPIGLOBAL 494.20

LXCHEM 477.20

MFL 936.50

NAHARINDUS 150.45

ONWARDTEC 390.30

PANACEABIO 264.95

SUULD 319.05

TEJASNET 447.10

DIGJAMLMTD 253.90

NDL 144.50

PFOCUS 84.30

SMARTLINK 173.95

ZENTEC 220.30

ARCHIDPLY 53.90

BGRENERGY 93.90

SURYALAXMI 85.55

LAGNAM 96.20

BIGBLOC 84.75

DCW 48.75

AMDIND 50.00

ADSL 130.15

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

|---|---|---|---|---|

| BSE | 55938 | 2071.65 | 2078.05 | 0.31 |

| CREDITACC | 13428 | 651.80 | 654.20 | 0.37 |

| DIVISLAB (F&O) | 44962 | 4190.00 | 4219.65 | 0.70 |

| BRIGADE | 35938 | 517.55 | 521.70 | 0.80 |

| GODREJCP (F&O) | 40517 | 901.30 | 910.30 | 0.99 |

| DLINKINDIA | 15034 | 170.90 | 172.80 | 1.10 |

| BIOCON (F&O) | 66511 | 382.50 | 387.25 | 1.23 |

| GSPL (F&O) | 14778 | 307.90 | 314.20 | 2.01 |

| ELGIEQUIP | 68994 | 373.35 | 381.90 | 2.24 |

| DEVYANI | 43186 | 174.90 | 179.15 | 2.37 |

| ANURAS | 56062 | 1025.00 | 1051.55 | 2.52 |

| DEEPAKNTR (F&O) | 71332 | 2298.95 | 2362.40 | 2.69 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

Strategy: IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

|---|---|---|---|---|---|---|---|

| SYNGENE (F&O) | 17498 | 588.06 | 558.42 | 612.26 | 585.35 | 586.40 | -0.18 |

| HINDUNILVR (F&O) | 74815 | 2328.06 | 2269.27 | 2375.37 | 2327.90 | 2334.35 | -0.28 |

| KPRMILL | 25767 | 722.27 | 689.41 | 749.02 | 716.75 | 720.00 | -0.45 |

| KEI | 26739 | 1130.64 | 1089.54 | 1163.93 | 1129.00 | 1134.40 | -0.48 |

| PVR (F&O) | 22842 | 1610.02 | 1561.03 | 1649.57 | 1600.95 | 1609.50 | -0.53 |

| DELTACORP (F&O) | 22657 | 289.00 | 268.27 | 306.10 | 287.55 | 289.10 | -0.54 |

| BURGERKING | 10100 | 138.06 | 123.83 | 149.99 | 136.35 | 137.10 | -0.55 |

| VGUARD | 16190 | 217.56 | 199.62 | 232.45 | 217.50 | 219.00 | -0.69 |

| EQUITAS | 14687 | 115.56 | 102.57 | 126.50 | 114.00 | 114.80 | -0.70 |

| GRASIM (F&O) | 31612 | 1785.06 | 1733.51 | 1826.65 | 1778.10 | 1791.80 | -0.77 |

| BEML | 26592 | 1849.00 | 1796.54 | 1891.30 | 1842.60 | 1860.00 | -0.94 |

| JSL | 11645 | 213.89 | 196.10 | 228.65 | 210.40 | 212.80 | -1.14 |

| SCHNEIDER | 10700 | 110.25 | 97.56 | 120.94 | 108.75 | 110.00 | -1.15 |

| GREAVESCOT | 18049 | 213.89 | 196.10 | 228.65 | 213.35 | 215.80 | -1.15 |

| LATENTVIEW | 47512 | 523.27 | 495.31 | 546.12 | 517.60 | 524.65 | -1.36 |

| ADANIPOWER | 31083 | 110.25 | 97.56 | 120.94 | 108.35 | 110.00 | -1.52 |

| ORIENTCEM | 12073 | 175.56 | 159.47 | 188.97 | 172.60 | 175.50 | -1.68 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

|---|---|---|---|---|---|---|---|

| JAMNAAUTO | 13276 | 102.52 | 115.50 | 92.69 | 104.80 | 103.00 | 1.72 |

| DATAPATTNS | 17001 | 715.56 | 749.02 | 689.41 | 720.85 | 706.00 | 2.06 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS

(In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| HINDUNILVR (F&O) | 0.25% |

| CDSL | 1.70% |

| SUNTECK | 2.04% |

| PRESTIGE | 2.80% |

| APTECHT | 3.10% |

| SUPRIYA | 3.10% |

| HEROMOTOCO (F&O) | 3.20% |

| AFFLE | 3.80% |

| TWL | 4.23% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| SYNGENE (F&O) | 0.18% |

| BALMLAWRIE | 0.27% |

| KPRMILL | 0.45% |

| KEI | 0.48% |

| PVR (F&O) | 0.53% |

| DELTACORP (F&O) | 0.54% |

| BURGERKING | 0.55% |

| MGL (F&O) | 0.59% |

| VGUARD | 0.69% |

| EQUITAS | 0.70% |

| HINDUNILVR (F&O) | 0.73% |

| IBULHSGFIN (F&O) | 0.77% |

| GRASIM (F&O) | 0.77% |

| BERGEPAINT (F&O) | 0.87% |

| BEML | 0.94% |

| VARROC | 1.04% |

| JSL | 1.14% |

| SCHNEIDER | 1.15% |

| GREAVESCOT | 1.15% |

| ANGELONE | 1.28% |

| LATENTVIEW | 1.36% |

| BAJFINANCE (F&O) | 1.41% |

| NOCIL | 1.46% |

| ADANIPOWER | 1.52% |

| ORIENTCEM | 1.68% |

| RAILTEL | 1.69% |

| BANDHANBNK (F&O) | 1.70% |

| KIRLOSENG | 1.75% |

| PRECAM | 1.75% |

| MIRZAINT | 1.86% |

| UFLEX | 1.86% |

| DMART | 1.89% |

| RAYMOND | 1.93% |

| HINDCOPPER | 2.31% |

| KABRAEXTRU | 2.34% |

| RALLIS | 2.40% |

| SOBHA | 2.45% |

| WELSPUNIND | 2.45% |

| ANDHRSUGAR | 2.53% |

| PRESTIGE | 2.60% |

| HEROMOTOCO (F&O) | 2.76% |

| DCAL | 2.78% |

| SRF (F&O) | 2.87% |

| DHAMPURSUG | 2.98% |

| CROMPTON (F&O) | 3.16% |

| NH | 3.17% |

| JUSTDIAL | 3.25% |

| FILATEX | 3.36% |

| CENTENKA | 3.38% |

| CDSL | 3.47% |

| SBILIFE (F&O) | 3.53% |

| BALPHARMA | 3.96% |

| RADICO | 4.04% |

| JAMNAAUTO | 4.15% |

| SONACOMS | 4.18% |

| GUFICBIO | 4.19% |

| GNFC | 4.42% |

| SEQUENT | 4.95% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

MSTCLTD SELL @ 344 or BELOW

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

NIL

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

AMBER

BESTAGRO

EXIDEIND (F&O)

MFSL (F&O)

NIITLTD

RAJESHEXPO

RHIM

ROUTE

TARSONS

UTIAMC

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

GUJALKALI

GULPOLY

JKTYRE

NITINSPIN

PGEL

RAYMOND

SUNTECK

TRITURBINE

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

HINDUNILVR (F&O)

SUPRAJIT

Lower Level Consolidation

NIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

BIOCON (F&O)

BODALCHEM

DIVISLAB (F&O)

GLENMARK (F&O)

IIFL

INDUSINDBK (F&O)

IRB

ITC (F&O)

JKPAPER

JUBLINGREA

KEC

KEI

KIRLFER

MAPMYINDIA

MGL (F&O)

MOL

RELIGARE

VIPIND

ZENTEC

GAP DOWN BREAKOUT STOCKS

ADSL

GAEL

IFBIND

Strategy : ENGULFING STOCKS

BULLISH ENGULFING PATTERN

AIROLAM

DIGJAMLMTD

NAHARPOLY

SONACOMS

BEARISH ENGULFING PATTERN

GTPL

JTLINFRA

JUBLFOOD (F&O)

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

JINDALPHOT

JINDRILL

NAHARPOLY

TRIGYN

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

ARIHANTCAP

GRINDWELL

HDFCLIFE (F&O)

KHADIM

MAPMYINDIA

NAHARINDUS

SPANDANA

BEARISH BELLHOLD PATTERN

JKLAKSHMI

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF INVESTORS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

10%+ lower than 52 Week low level

UJJIVAN

RBLBANK (F&O)

JUBLPHARMA

RAMCOSYS

AMARAJABAT (F&O)

GULFOILLUB

HUHTAMAKI

WHIRLPOOL (F&O)

AUROPHARMA (F&O)

ALKYLAMINE

AEGISCHEM

HDFCAMC (F&O

SEQUENT

EPL

MAHEPC

IGL (F&O)

CEATLTD

SOLARA

INDIAMART (F&O)

WOCKPHARMA

INDOSTAR

CHEMCON

MGL (F&O)

CUB (F&O

APLLTD (F&O)

LICHSGFIN (F&O)

CREDITACC

BAJAJCON

SBICARD (F&O)

WATERBASE

DBL

BIOCON (F&O)

CADILAHC (F&O)

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

HEG

JUBLFOOD (F&O)

AARTIIND (F&O)

TECHM (F&O)

RAMCOCEM (F&O)

MAXHEALTH

CROMPTON (F&O)

ICICIPRULI (F&O)

INDIGO (F&O)

PCBL

PAYTM

STARHEALTH

AFFLE

PETRONET (F&O)

PRSMJOHNSN

CARTRADE

EIDPARRY

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

(14 DAYS RSI DOWN & PRICE UP)

SIS

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

ABCAPITAL

AMIORG

BEPL

BURGERKING

EQUITAS

FINCABLES

GATI

GOACARBON

GUFICBIO

HAPPSTMNDS

HERCULES

HPAL

KIRLOSENG

KPRMILL

SAKSOFT

SCHNEIDER

SPANDANA

SPENCERS

SURYAROSNI

TEGA

TIINDIA

TNPETRO

WABAG

ZENSARTECH

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

NIL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROSSED ON THE DOWN SIDE FOR GOING SHORT

NIL

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

|---|---|---|---|---|---|---|---|

| TATACONSUM (F&O) | 742.45 | 742.56 | 735.77 | 749.02 | 755.87 | 762.76 | 769.68 |

| HINDUNILVR (F&O) | 2327.90 | 2328.06 | 2316.02 | 2338.97 | 2351.07 | 2363.21 | 2375.37 |

| TECHM (F&O) | 1482.95 | 1491.89 | 1482.25 | 1500.81 | 1510.51 | 1520.24 | 1530.00 |

| MGEL | 151.65 | 153.14 | 150.06 | 156.17 | 159.31 | 162.48 | 165.68 |

| GODREJCP (F&O) | 910.30 | 915.06 | 907.52 | 922.18 | 929.78 | 937.42 | 945.09 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

|---|---|---|---|---|---|---|---|

| HEROMOTOCO (F&O) | 2702.40 | 2691.02 | 2704.00 | 2679.40 | 2666.47 | 2653.58 | 2640.71 |

| TVSMOTOR (F&O) | 626.15 | 625.00 | 631.27 | 619.08 | 612.87 | 606.69 | 600.55 |

| UPL (F&O) | 785.95 | 784.00 | 791.02 | 777.40 | 770.45 | 763.52 | 756.63 |

| SHILPAMED | 509.85 | 506.25 | 511.89 | 500.89 | 495.31 | 489.76 | 484.24 |

| MCDOWELL-N (F&O) | 887.05 | 885.06 | 892.52 | 878.08 | 870.69 | 863.32 | 855.99 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| BANKBARODA (F&O) | 47769665 | 109.40 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| CANBK (F&O) | 27204313 | 269.65 | 272.25 | 268.14 | 276.25 | 280.42 | 284.62 | 288.86 |

| NATIONALUM (F&O) | 26715512 | 116.05 | 118.27 | 115.56 | 120.94 | 123.70 | 126.50 | 129.33 |

| NMDC (F&O) | 19662509 | 150.50 | 153.14 | 150.06 | 156.17 | 159.31 | 162.48 | 165.68 |

| ASHOKLEY (F&O) | 17772636 | 134.05 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| RBLBANK (F&O) | 17053519 | 154.70 | 156.25 | 153.14 | 159.31 | 162.48 | 165.68 | 168.92 |

| AXISBANK (F&O) | 13478899 | 804.10 | 805.14 | 798.06 | 811.84 | 818.98 | 826.15 | 833.35 |

| IEX (F&O) | 10421249 | 239.75 | 240.25 | 236.39 | 244.02 | 247.94 | 251.89 | 255.87 |

| IOC (F&O) | 9832796 | 124.45 | 126.56 | 123.77 | 129.33 | 132.18 | 135.07 | 137.99 |

| ABCAPITAL | 9367192 | 126.25 | 126.56 | 123.77 | 129.33 | 132.18 | 135.07 | 137.99 |

| LICHSGFIN (F&O) | 8477068 | 403.60 | 405.02 | 400.00 | 409.86 | 414.93 | 420.04 | 425.18 |

| IBULHSGFIN (F&O) | 8096886 | 219.55 | 221.27 | 217.56 | 224.89 | 228.65 | 232.45 | 236.27 |

| HDFCBANK (F&O) | 6984645 | 1531.20 | 1540.56 | 1530.77 | 1549.62 | 1559.47 | 1569.36 | 1579.27 |

| HCLTECH (F&O) | 6982539 | 1170.95 | 1173.06 | 1164.52 | 1181.05 | 1189.65 | 1198.29 | 1206.96 |

| DEVYANI | 6014602 | 179.15 | 182.25 | 178.89 | 185.55 | 188.97 | 192.42 | 195.90 |

| RELINFRA | 5451390 | 110.10 | 110.25 | 107.64 | 112.83 | 115.50 | 118.21 | 120.94 |

| IRB | 5331372 | 279.30 | 280.56 | 276.39 | 284.62 | 288.86 | 293.12 | 297.41 |

| BIOCON (F&O) | 4529790 | 387.25 | 390.06 | 385.14 | 394.82 | 399.80 | 404.81 | 409.86 |

| APOLLOTYRE (F&O) | 4434266 | 225.35 | 228.77 | 225.00 | 232.45 | 236.27 | 240.13 | 244.02 |

| FSL (F&O) | 4054618 | 166.90 | 169.00 | 165.77 | 172.18 | 175.47 | 178.80 | 182.16 |

| JAICORPLTD | 3784544 | 142.50 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| AGSTRA | 3292939 | 165.80 | 169.00 | 165.77 | 172.18 | 175.47 | 178.80 | 182.16 |

| FILATEX | 3280194 | 122.00 | 123.77 | 121.00 | 126.50 | 129.33 | 132.18 | 135.07 |

| HDFCLIFE (F&O) | 2989002 | 644.15 | 650.25 | 643.89 | 656.31 | 662.73 | 669.18 | 675.66 |

| SPARC | 2882717 | 344.20 | 346.89 | 342.25 | 351.39 | 356.09 | 360.82 | 365.58 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| CHOLAFIN (F&O) | 7515581 | 639.20 | 637.56 | 643.89 | 631.58 | 625.31 | 619.08 | 612.87 |

| POONAWALLA | 5177888 | 272.00 | 268.14 | 272.25 | 264.19 | 260.15 | 256.13 | 252.14 |

| BALRAMCHIN | 4314721 | 415.30 | 415.14 | 420.25 | 410.27 | 405.22 | 400.20 | 395.21 |

| CHAMBLFERT (F&O) | 2908612 | 403.50 | 400.00 | 405.02 | 395.21 | 390.26 | 385.33 | 380.44 |

| JUBLFOOD (F&O) | 2426506 | 3301.60 | 3291.89 | 3306.25 | 3279.20 | 3264.90 | 3250.62 | 3236.38 |

| GPIL | 1045004 | 317.55 | 315.06 | 319.52 | 310.80 | 306.40 | 302.04 | 297.71 |

| SHALBY | 497021 | 140.05 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| JKLAKSHMI | 475634 | 569.90 | 564.06 | 570.02 | 558.42 | 552.53 | 546.66 | 540.83 |

| ANMOL | 410830 | 205.90 | 203.06 | 206.64 | 199.62 | 196.10 | 192.61 | 189.16 |

| ALKYLAMINE | 332196 | 3211.30 | 3206.39 | 3220.56 | 3193.85 | 3179.73 | 3165.64 | 3151.59 |

| INDIANHUME | 232799 | 227.60 | 225.00 | 228.77 | 221.38 | 217.67 | 214.00 | 210.36 |

| CARTRADE | 221582 | 739.25 | 735.77 | 742.56 | 729.36 | 722.63 | 715.92 | 709.25 |

| ADSL | 212333 | 130.15 | 129.39 | 132.25 | 126.63 | 123.83 | 121.06 | 118.32 |

| SUPREMEIND | 199459 | 2092.65 | 2081.64 | 2093.06 | 2071.29 | 2059.92 | 2048.59 | 2037.28 |

| SANDHAR | 171975 | 245.40 | 244.14 | 248.06 | 240.37 | 236.51 | 232.68 | 228.88 |

| BALKRISIND (F&O) | 160659 | 2320.75 | 2316.02 | 2328.06 | 2305.15 | 2293.16 | 2281.20 | 2269.27 |