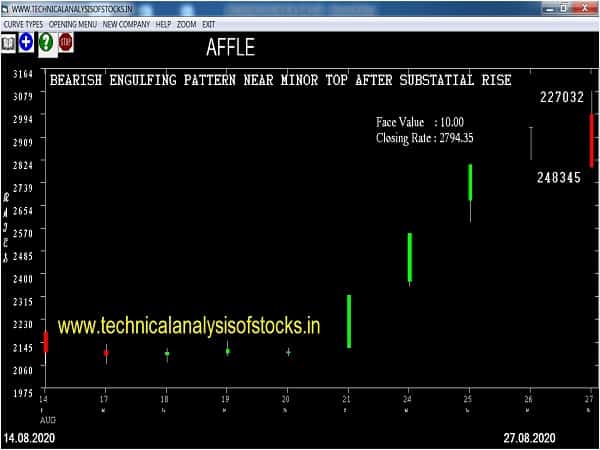

SELL AFFLE (NSE Code) Sell Below 2782.55 after cooling period. SIGNAL : BEARISH ENGULFING PATTERN NEAR MINOR TOP AFTER SUBSTANTIAL RISE. Stop Loss : 2847.50 Target : 2731.45 (Short term)

HOT BUZZING STOCKS (28.08.2020)

NSE SYMBOL CLOSING RATE

WENDT 3887.00

NUCLEUS 525.90

RUBYMILLS 205.00

EMKAY 59.60

DATAMATICS 74.10

GULPOLY 54.60

INTELLECT 192.15

REPCOHOME 177.60

WELSPUNIND 54.60

EXPLEOSOL 509.85

FLFL 138.80

RAMCOSYS 257.75

TANLA 253.60

ASHAPURMIN 64.45

GLOBUSSPR 186.80

ROSSELLIND 126.75

HOVS 45.50

SORILINFRA 78.30

MACPOWER 71.00

MAGMA 40.25

LASA 66.95

GREENPANEL 50.00

OPTIEMUS 50.05

SDBL 63.90

AFFLE 2794.35

Strategy : TRIANGLE PATTERN (Intraday/Short term)

RANEHOLDING Buy @ 540 or above

CANBK (F&O) Buy @ 109 or above

MPHASIS Sell @ 1181 or below

ABFRL Sell @ 143 or below

APCOTEXIND Sell @ 160 or below

CARBORUNIV Sell @ 270 or below

TORNTPOWER (F&O) Sell @ 342 or below

CYIENT Sell @ 373 or below

GODREJAGRO Sell @ 487 or below

Strategy : INSIDE CANDLES (Intraday/Short term)

CANBK (F&O) Buy @ 109 or Above

SWANENERGY Sell @ 128 or below

ABFRL Sell @ 143 or below

GHCL Sell @ 165 or below

RITES Sell @ 251 or below

SUMICHEM Sell @ 280 or below

Strategy : NR4 BREKOUT (EITHER WAY) INTRADAY

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

AARTIIND

ADANIENT (F&O)

GHCL

LICHSGFIN (F&O)

NESCO

SYNGENE

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

AMARAJABAT (F&O)

CONCOR (F&O)

JINDALSAW

SWANENERGY

TCS (F&O)

HCD

Higher Level Consolidation

AMARAJABAT (F&O)

Lower Level Consolidation

BPCL (F&O)

COLPAL (F&O)

Strategy : BREAK OUT STOCKS

GAP UP BREAKOUT STOCKS

APOLLOTYRE (F&O)

BANDHANBNK (F&O)

CAREERP

GODREJPROP (F&O)

JAICORPLTD

LIBERTSHOE

OBEROIRLTY

PRESTIGE

PRINCEPIPE

REPCOHOME

SBIN (F&O)

SUNTECK

TATAMOTORS (F&O)

GAP DOWN BREAKOUT STOCKS

CUPID

HAL

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

NIL

BEARISH ENGULFING

AFFLE

SIEMENS

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NIL

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELL HOLD PATTERN STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

NIL

Strategy : GARTLEY SIGNAL (W & M Patterns) (INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

ADANIGAS

AMBUJACEM (F&O)

EMAMILTD

MSTCLTD

TATAPOWER (F&O)

TCS (F&O)

SELL RECOMMENDATION IF THE MARKET IS BEARISH

CASTROLIND

DBL

EMKAY

GLAXO

GODREJPROP (F&O)

GSPL

HDFCLIFE (F&O)

IGL (F&O)

MGL (F&O)

POWERGRID (F&O)

SUNDRMFAST

TITAN (F&O)

ULTRACEMCO (F&O)

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| AARTIIND | 1124.35 | 1130.64 | 1122.25 | 1138.49 | 1146.94 | 1155.42 | 1163.93 |

| INDIGO (F&O) | 1185.70 | 1190.25 | 1181.64 | 1198.29 | 1206.96 | 1215.66 | 1224.39 |

| JKCEMENT | 1517.70 | 1521.00 | 1511.27 | 1530.00 | 1539.79 | 1549.62 | 1559.47 |

| ICICIGI | 1276.65 | 1278.06 | 1269.14 | 1286.37 | 1295.35 | 1304.36 | 1313.41 |

| RITES | 257.30 | 260.02 | 256.00 | 263.93 | 268.01 | 272.11 | 276.25 |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| CADILAHC (F&O) | 389.10 | 385.14 | 390.06 | 380.44 | 375.58 | 370.75 | 365.95 |

| TINPLATE | 147.55 | 147.02 | 150.06 | 144.07 | 141.09 | 138.13 | 135.21 |

| DALBHARAT | 740.30 | 735.77 | 742.56 | 729.36 | 722.63 | 715.92 | 709.25 |

| TECHM (F&O) | 735.60 | 729.00 | 735.77 | 722.63 | 715.92 | 709.25 | 702.60 |

| IFBIND | 509.50 | 506.25 | 511.89 | 500.89 | 495.31 | 489.76 | 484.24 |

| INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| DLF (F&O) | 76444741 | 175.90 | 178.89 | 175.56 | 182.16 | 185.55 | 188.97 | 192.42 |

| BANDHANBNK (F&O) | 40880245 | 311.10 | 315.06 | 310.64 | 319.36 | 323.84 | 328.35 | 332.90 |

| FRETAIL | 28266946 | 130.10 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| APOLLOTYRE (F&O) | 22833181 | 135.50 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| CENTURYTEX (F&O) | 9902857 | 374.80 | 375.39 | 370.56 | 380.06 | 384.95 | 389.87 | 394.82 |

| HDFC (F&O) | 8648531 | 1864.10 | 1870.56 | 1859.77 | 1880.45 | 1891.30 | 1902.19 | 1913.11 |

| GREAVESCOT | 6500382 | 88.50 | 90.25 | 87.89 | 92.59 | 95.01 | 97.47 | 99.95 |

| GODREJPROP (F&O) | 6276125 | 910.15 | 915.06 | 907.52 | 922.18 | 929.78 | 937.42 | 945.09 |

| GLENMARK (F&O) | 5350911 | 497.75 | 500.64 | 495.06 | 506.00 | 511.63 | 517.30 | 523.00 |

| INDHOTEL | 5167127 | 106.75 | 107.64 | 105.06 | 110.19 | 112.83 | 115.50 | 118.21 |

| DLINKINDIA | 4948802 | 130.70 | 132.25 | 129.39 | 135.07 | 137.99 | 140.95 | 143.93 |

| PNBHOUSING | 4925782 | 298.30 | 301.89 | 297.56 | 306.10 | 310.49 | 314.90 | 319.36 |

| PEL (F&O) | 4805866 | 1521.60 | 1530.77 | 1521.00 | 1539.79 | 1549.62 | 1559.47 | 1569.36 |

| JAICORPLTD | 4659930 | 100.05 | 102.52 | 100.00 | 105.01 | 107.59 | 110.19 | 112.83 |

| BHARATFORG (F&O) | 4404470 | 510.90 | 511.89 | 506.25 | 517.30 | 523.00 | 528.74 | 534.50 |

| STAR | 4067368 | 640.85 | 643.89 | 637.56 | 649.92 | 656.31 | 662.73 | 669.18 |

| EIHOTEL | 3517072 | 91.80 | 92.64 | 90.25 | 95.01 | 97.47 | 99.95 | 102.46 |

| LIBERTSHOE | 3474928 | 168.05 | 169.00 | 165.77 | 172.18 | 175.47 | 178.80 | 182.16 |

| PRESTIGE | 2669034 | 259.85 | 260.02 | 256.00 | 263.93 | 268.01 | 272.11 | 276.25 |

| CENTURYPLY | 2432180 | 157.60 | 159.39 | 156.25 | 162.48 | 165.68 | 168.92 | 172.18 |

| CAMLINFINE | 2429891 | 98.95 | 100.00 | 97.52 | 102.46 | 105.01 | 107.59 | 110.19 |

| ASTRAMICRO | 2361650 | 128.80 | 129.39 | 126.56 | 132.18 | 135.07 | 137.99 | 140.95 |

| DHAMPURSUG | 2299997 | 158.65 | 159.39 | 156.25 | 162.48 | 165.68 | 168.92 | 172.18 |

| HINDZINC | 2265073 | 237.15 | 240.25 | 236.39 | 244.02 | 247.94 | 251.89 | 255.87 |

| OBEROIRLTY | 2139245 | 393.35 | 395.02 | 390.06 | 399.80 | 404.81 | 409.86 | 414.93 |

| KITEX | 2107531 | 114.10 | 115.56 | 112.89 | 118.21 | 120.94 | 123.70 | 126.50 |

| GREENPLY | 2001528 | 96.20 | 97.52 | 95.06 | 99.95 | 102.46 | 105.01 | 107.59 |

| SOBHA | 1942357 | 272.90 | 276.39 | 272.25 | 280.42 | 284.62 | 288.86 | 293.12 |

| GUJALKALI | 1881491 | 369.90 | 370.56 | 365.77 | 375.20 | 380.06 | 384.95 | 389.87 |

| BATAINDIA (F&O) | 1869933 | 1351.15 | 1359.77 | 1350.56 | 1368.32 | 1377.58 | 1386.87 | 1396.19 |

| TATAELXSI | 1802901 | 1153.75 | 1156.00 | 1147.52 | 1163.93 | 1172.48 | 1181.05 | 1189.65 |

| SUNTECK | 1673529 | 276.05 | 276.39 | 272.25 | 280.42 | 284.62 | 288.86 | 293.12 |

| BFUTILITIE | 1557317 | 291.75 | 293.27 | 289.00 | 297.41 | 301.74 | 306.10 | 310.49 |

| CYIENT | 1537301 | 394.05 | 395.02 | 390.06 | 399.80 | 404.81 | 409.86 | 414.93 |

| INDIANHUME | 1371272 | 210.15 | 210.25 | 206.64 | 213.78 | 217.45 | 221.15 | 224.89 |

| AEGISCHEM | 1233802 | 215.85 | 217.56 | 213.89 | 221.15 | 224.89 | 228.65 | 232.45 |

| KANSAINER | 1225722 | 498.70 | 500.64 | 495.06 | 506.00 | 511.63 | 517.30 | 523.00 |

| BSE | 997562 | 514.65 | 517.56 | 511.89 | 523.00 | 528.74 | 534.50 | 540.29 |

| RADICO | 982213 | 420.80 | 425.39 | 420.25 | 430.35 | 435.55 | 440.78 | 446.04 |

| BLUESTARCO | 957851 | 685.15 | 689.06 | 682.52 | 695.29 | 701.90 | 708.54 | 715.20 |

| DBCORP | 917131 | 80.65 | 81.00 | 78.77 | 83.22 | 85.52 | 87.85 | 90.20 |

| KOLTEPATIL | 908810 | 185.30 | 185.64 | 182.25 | 188.97 | 192.42 | 195.90 | 199.42 |

| SCHNEIDER | 908416 | 87.10 | 87.89 | 85.56 | 90.20 | 92.59 | 95.01 | 97.47 |

| KEI | 898736 | 406.50 | 410.06 | 405.02 | 414.93 | 420.04 | 425.18 | 430.35 |

| WOCKPHARMA | 805592 | 326.90 | 328.52 | 324.00 | 332.90 | 337.47 | 342.08 | 346.72 |

| WSTCSTPAPR | 740912 | 198.55 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| SATIN | 614554 | 79.50 | 81.00 | 78.77 | 83.22 | 85.52 | 87.85 | 90.20 |

| FSC | 529416 | 148.05 | 150.06 | 147.02 | 153.06 | 156.17 | 159.31 | 162.48 |

| ARVSMART | 498697 | 105.25 | 107.64 | 105.06 | 110.19 | 112.83 | 115.50 | 118.21 |

| FLFL | 473032 | 138.80 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| NELCO | 447643 | 216.85 | 217.56 | 213.89 | 221.15 | 224.89 | 228.65 | 232.45 |

| DALMIASUG | 444213 | 144.45 | 147.02 | 144.00 | 149.99 | 153.06 | 156.17 | 159.31 |

| CREDITACC | 378783 | 656.90 | 663.06 | 656.64 | 669.18 | 675.66 | 682.17 | 688.72 |

| VISAKAIND | 290886 | 373.55 | 375.39 | 370.56 | 380.06 | 384.95 | 389.87 | 394.82 |

| IMFA | 277986 | 251.05 | 252.02 | 248.06 | 255.87 | 259.89 | 263.93 | 268.01 |

| JINDALPOLY | 222024 | 502.15 | 506.25 | 500.64 | 511.63 | 517.30 | 523.00 | 528.74 |

| INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| ITC (F&O) | 47213462 | 194.25 | 192.52 | 196.00 | 189.16 | 185.73 | 182.34 | 178.98 |

| VEDL (F&O) | 21935103 | 127.85 | 126.56 | 129.39 | 123.83 | 121.06 | 118.32 | 115.62 |

| IGL (F&O) | 7574608 | 406.90 | 405.02 | 410.06 | 400.20 | 395.21 | 390.26 | 385.33 |

| HAL | 5831221 | 1010.80 | 1008.06 | 1016.02 | 1000.64 | 992.75 | 984.88 | 977.05 |

| HINDOILEXP | 1956241 | 84.85 | 83.27 | 85.56 | 81.04 | 78.81 | 76.60 | 74.43 |

| FORTIS | 1386115 | 135.60 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| SHILPAMED | 1020517 | 573.00 | 570.02 | 576.00 | 564.34 | 558.42 | 552.53 | 546.66 |

| REDINGTON | 951952 | 116.45 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| GPIL | 634754 | 324.15 | 324.00 | 328.52 | 319.68 | 315.22 | 310.80 | 306.40 |

| WESTLIFE | 392822 | 371.85 | 370.56 | 375.39 | 365.95 | 361.18 | 356.44 | 351.74 |

| DOLLAR | 309109 | 157.00 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |