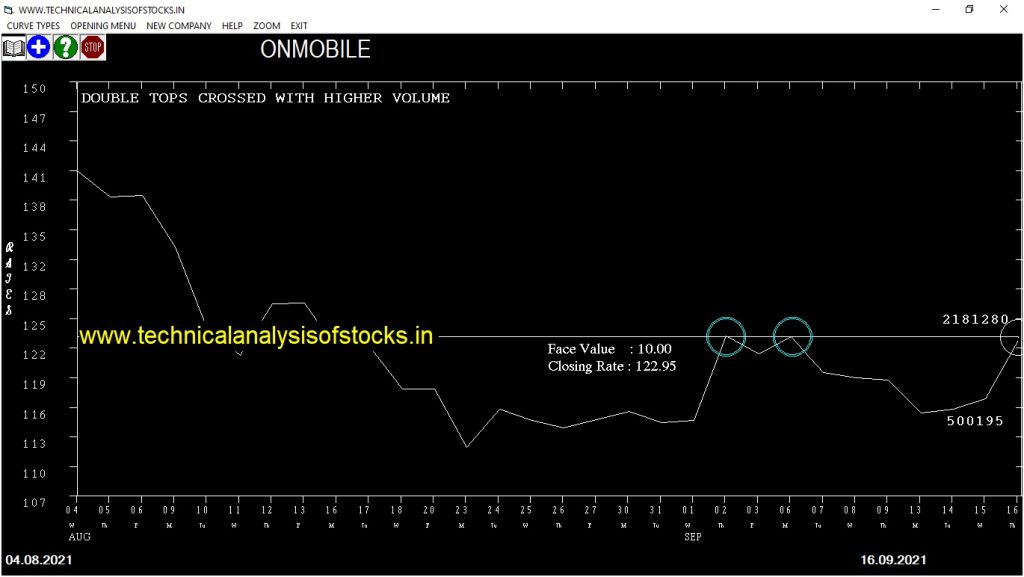

BUY ONMOBILE (NSE Symbol) Buy@ 123.75 or Above after cooling period. SIGNAL : DOUBLE TOPS CROSSED WITH HIGHER VOLUME. Stop Loss : 110.30 Target : 135.05 (Short term)

HOT BUZZING STOCKS (17.09.2020)

NSE SYMBOL CLOSING RATE

| CTE | 63.10 |

| JINDALPHOT | 114.70 |

| XPROINDIA | 432.20 |

| GOLDENTOBC | 98.30 |

| KPIGLOBAL | 138.40 |

| SHEMAROO | 154.05 |

| MCDHOLDING | 63.60 |

| SIMPLEXINF | 46.95 |

| MCL | 42.20 |

| ZENTEC | 204.10 |

| LXCHEM | 568.20 |

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| DBL | 16318 | 525.90 | 527.95 | 0.39 |

| AXISBANK (F&O) | 167642 | 799.40 | 802.60 | 0.40 |

| M&MFIN (F&O) | 49186 | 171.00 | 173.60 | 1.50 |

| SHOPERSTOP | 26877 | 259.40 | 264.75 | 2.02 |

| MINDAIND | 42087 | 714.90 | 732.75 | 2.44 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| ACC (F&O) | 19609 | 2431.25 | 2429.70 | 0.06 |

| CHEMPLASTS | 16401 | 556.25 | 555.45 | 0.14 |

| APTUS | 27903 | 359.05 | 356.70 | 0.66 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| MARUTI (F&O) | 61217 | 6951.39 | 6850.99 | 7031.50 | 6930.95 | 6958.00 | -0.39 |

| CIPLA (F&O) | 59496 | 961.00 | 923.10 | 991.75 | 954.00 | 960.00 | -0.63 |

| KEI | 42712 | 841.00 | 805.54 | 869.81 | 835.45 | 841.00 | -0.66 |

| PEL (F&O) | 42502 | 2652.25 | 2589.56 | 2702.65 | 2648.65 | 2674.95 | -0.99 |

| VBL | 12188 | 937.89 | 900.45 | 968.28 | 933.70 | 946.00 | -1.32 |

| ASTRAL (F&O) | 19828 | 2127.52 | 2071.29 | 2172.80 | 2127.50 | 2160.00 | -1.53 |

| TATACOFFEE | 30683 | 213.89 | 196.10 | 228.65 | 212.35 | 216.25 | -1.84 |

| MAZDOCK | 29183 | 260.02 | 240.37 | 276.25 | 257.20 | 262.35 | -2.00 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| JUSTDIAL | 11955 | 984.39 | 1023.49 | 953.74 | 988.00 | 981.00 | 0.71 |

| EXIDEIND (F&O) | 37207 | 182.25 | 199.42 | 169.08 | 182.85 | 181.15 | 0.93 |

| TATACONSUM (F&O) | 37571 | 870.25 | 907.06 | 841.42 | 874.00 | 864.95 | 1.04 |

| DIVISLAB (F&O) | 36681 | 5166.02 | 5253.62 | 5096.94 | 5166.90 | 5048.05 | 2.30 |

| ZOMATO | 127218 | 141.02 | 156.17 | 129.46 | 142.05 | 138.55 | 2.46 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| VBL | 1.32% |

| CUB (F&O) | 2.41% |

| MCX (F&O) | 2.42% |

| UPL (F&O) | 2.45% |

| POLYCAB (F&O) | 2.49% |

| STOVEKRAFT | 2.60% |

| SONATSOFTW | 2.63% |

| HDFCLIFE (F&O) | 2.71% |

| BODALCHEM | 3.22% |

| CARTRADE | 3.51% |

| NMDC (F&O) | 3.52% |

| ELECON | 4.55% |

| PNCINFRA | 4.95% |

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

| SYMBOL | % DIF |

| ERIS | 0.19% |

| MARUTI (F&O) | 0.39% |

| POWERMECH | 0.63% |

| KEI | 0.66% |

| MUTHOOTFIN (F&O) | 0.74% |

| CIPLA (F&O) | 0.94% |

| PEL (F&O) | 0.99% |

| JUSTDIAL | 1.06% |

| DIVISLAB (F&O) | 1.09% |

| SONATSOFTW | 1.29% |

| ASTRAL (F&O) | 1.53% |

| ASIANPAINT (F&O) | 1.57% |

| TATACONSUM (F&O) | 1.72% |

| EXIDEIND (F&O) | 1.75% |

| ICICIGI (F&O) | 1.80% |

| TATACOFFEE | 1.84% |

| VRLLOG | 1.94% |

| LICHSGFIN (F&O) | 1.95% |

| MAZDOCK | 2.00% |

| LINDEINDIA | 2.16% |

| DIXON (F&O) | 2.27% |

| ACC (F&O) | 2.35% |

| NATCOPHARM | 2.36% |

| MCX (F&O) | 2.41% |

| BAJFINANCE (F&O) | 2.53% |

| LUPIN (F&O) | 2.76% |

| BAJAJFINSV (F&O) | 2.79% |

| WIPRO (F&O) | 3.12% |

| STLTECH | 3.17% |

| KIRLFER | 3.20% |

| BANCOINDIA | 3.29% |

| JYOTHYLAB | 3.30% |

| OBEROIRLTY | 3.37% |

| ZOMATO | 3.38% |

| WELSPUNIND | 3.62% |

| IPCALAB (F&O) | 3.62% |

| JKPAPER | 4.07% |

| APTUS | 4.08% |

| VGUARD | 4.16% |

| GAEL | 4.27% |

| CANFINHOME (F&O) | 4.42% |

| BRIGADE | 4.55% |

| AUBANK (F&O) | 4.81% |

| SUDARSCHEM | 4.93% |

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

KNRCON Sell @ 307 or Below

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

GAIL (F&O) Sell @ 156.25 or Below

PVR (F&O) Sell @ 1406.25 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

APEX

CAMS

CESC

DIVISLAB (F&O)

ESTER

GAIL (F&O)

IOLCP

MOLDTKPAC

TNPETRO

ZOMATO

PREVIOUS 6 DAYS CANDLE HEIGHT SHRINKING STOCKS

ASIANTILES

JUSTDIAL

SELAN

SMARTLINK

TRENT (F&O)

VRLLOG

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

NIL

Higher Level Consolidation

CARERATING

Lower Level Consolidation

NIL

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

BLS

FCL

INDUSINDBK (F&O)

MINDACORP

MINDAIND

TATACHEM (F&O)

GAP DOWN BREAKOUT STOCKS

APLAPOLLO

BPCL (F&O)

HINDCOPPER

ZENTEC

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

BESTAGRO

MAZDOCK

PFOCUS

BEARISH ENGULFING

AUTOIND

BCLIND

GRAUWEIL

LAURUSLABS

LXCHEM

MAHLIFE

MFL

ROML

VISHNU

VISHWARAJ

Strategy : RSI DIVERGENCE STOCKS

RSI +ve DIVERGENCE STOCKS NEAR RSI 30

(14 DAYS RSI UP & PRICE DOWN)

NIL

RSI -ve DIVERGENCE STOCKS NEAR RSI 70

14 DAYS RSI NEAR 50 ON THE UP SIDE MOVE

NIACL

GLAND

PHILIPCARB

BANCOINDIA

CAPACITE

ISEC

CROMPTON

GESHIP

VIPIND

IRB

JUBLINGREA

HAL (F&O)

MCX (F&O)

ICICIGI (F&O)

TATACONSUM (F&O)

HDFCLIFE (F&O)

MARICO (F&O)

BSE

JUSTDIAL

MAXHEALTH

Strategy : MORNING OR EVENING STAR (LIKE) STOCKS

MORNING STAR (LIKE) CANDLESTICK PATTERN

Real Morning Star if the Doji Candlestick appears after a steep fall

DEEPINDS

KAJARIACER

VERTOZ

EVENING STAR (LIKE) CANDLESTICK PATTERN

Real Evening Star if the Doji Candlestick appears after a steep rise

DALBHARAT

LXCHEM

WHIRLPOOL

Strategy : HEAD & SHOULDER PATTERN STOCKS

INVERSE HEAD & SHOULDER PATTERN (LONG OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROOSED ON THE UP SIDE FOR GOING LONG

NIL

HEAD & SHOULDER PATTERN (SHORT OPPORTUNITIES)

WATCH FOR NECK LINE TO BE CROOSED ON THE DOWN SIDE FOR GOING SHORT

VIDHIING

WSTCSTPAPR

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

NACLIND

BEARISH MARUBOZU PATTERN

ROML

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

EASEMYTRIP

BEARISH BELLHOLD PATTERN

AKASH

GSS

LGBBROSLTD

PRECAM

RKFORGE

SHARDACROP

VISHNU

XCHANGING

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

ASHOKLEY (F&O)

BEPL

BORORENEW

GLENMARK (F&O)

ICICIGI (F&O)

NLCINDIA

RITES

STARCEMENT

UFO

SELL RECOMMENDATION IF THE MARKET IS BEARISH

BANDHANBNK (F&O)

EPL

GRANULES (F&O)

LUPIN (F&O)

MIDHANI

PETRONET (F&O)

SADBHAV

STOCKS TO BUY FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| EVEREADY | 371.90 | 375.39 | 370.56 | 380.06 | 384.95 | 389.87 | 394.82 |

| HINDZINC | 334.90 | 337.64 | 333.06 | 342.08 | 346.72 | 351.39 | 356.09 |

| VOLTAS (F&O) | 1248.00 | 1251.39 | 1242.56 | 1259.62 | 1268.51 | 1277.42 | 1286.37 |

| HATSUN | 1448.75 | 1453.52 | 1444.00 | 1462.33 | 1471.90 | 1481.51 | 1491.14 |

| ADANIPORTS (F&O) | 769.65 | 770.06 | 763.14 | 776.63 | 783.61 | 790.62 | 797.66 |

STOCKS TO SELL FOR INTRADAY

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| FACT | 126.10 | 123.77 | 126.56 | 121.06 | 118.32 | 115.62 | 112.95 |

| ORIENTCEM | 161.35 | 159.39 | 162.56 | 156.33 | 153.22 | 150.14 | 147.09 |

| SHANKARA | 564.40 | 564.06 | 570.02 | 558.42 | 552.53 | 546.66 | 540.83 |

| DBL | 527.95 | 523.27 | 529.00 | 517.82 | 512.15 | 506.50 | 500.89 |

| VIJAYA | 644.05 | 643.89 | 650.25 | 637.88 | 631.58 | 625.31 | 619.08 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| SBIN (F&O) | 42637448 | 463.70 | 467.64 | 462.25 | 472.83 | 478.28 | 483.76 | 489.27 |

| CANBK (F&O) | 37965546 | 166.75 | 169.00 | 165.77 | 172.18 | 175.47 | 178.80 | 182.16 |

| IBULHSGFIN (F&O) | 15679635 | 241.85 | 244.14 | 240.25 | 247.94 | 251.89 | 255.87 | 259.89 |

| RBLBANK (F&O) | 10780478 | 183.50 | 185.64 | 182.25 | 188.97 | 192.42 | 195.90 | 199.42 |

| RELIANCE (F&O) | 6206657 | 2428.20 | 2437.89 | 2425.56 | 2449.02 | 2461.41 | 2473.82 | 2486.27 |

| BANDHANBNK (F&O) | 6158204 | 297.65 | 301.89 | 297.56 | 306.10 | 310.49 | 314.90 | 319.36 |

| INDIANB | 5653785 | 139.20 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| JSL | 5604717 | 167.15 | 169.00 | 165.77 | 172.18 | 175.47 | 178.80 | 182.16 |

| HINDPETRO (F&O) | 5043065 | 282.50 | 284.77 | 280.56 | 288.86 | 293.12 | 297.41 | 301.74 |

| SUNTECK | 3765738 | 439.30 | 441.00 | 435.77 | 446.04 | 451.34 | 456.66 | 462.02 |

| IRCTC (F&O) | 3602211 | 3769.70 | 3782.25 | 3766.89 | 3795.74 | 3811.16 | 3826.60 | 3842.08 |

| DCAL | 3208161 | 217.55 | 217.56 | 213.89 | 221.15 | 224.89 | 228.65 | 232.45 |

| HAL | 2560555 | 1431.95 | 1434.52 | 1425.06 | 1443.28 | 1452.79 | 1462.33 | 1471.90 |

| MINDACORP | 2433443 | 133.50 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| BALMLAWRIE | 2424627 | 141.85 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| CASTROLIND | 2325497 | 141.65 | 144.00 | 141.02 | 146.94 | 149.99 | 153.06 | 156.17 |

| FINPIPE | 2189480 | 196.85 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| NIACL | 2086243 | 176.45 | 178.89 | 175.56 | 182.16 | 185.55 | 188.97 | 192.42 |

| CSBBANK | 2048137 | 316.85 | 319.52 | 315.06 | 323.84 | 328.35 | 332.90 | 337.47 |

| SRTRANSFIN (F&O) | 2028564 | 1406.40 | 1415.64 | 1406.25 | 1424.35 | 1433.80 | 1443.28 | 1452.79 |

| OIL | 1958389 | 211.50 | 213.89 | 210.25 | 217.45 | 221.15 | 224.89 | 228.65 |

| MAZDOCK | 1868642 | 257.20 | 260.02 | 256.00 | 263.93 | 268.01 | 272.11 | 276.25 |

| ALLCARGO | 1298033 | 245.75 | 248.06 | 244.14 | 251.89 | 255.87 | 259.89 | 263.93 |

| ELECON | 1269197 | 177.90 | 178.89 | 175.56 | 182.16 | 185.55 | 188.97 | 192.42 |

| VERTOZ | 1175266 | 100.15 | 102.52 | 100.00 | 105.01 | 107.59 | 110.19 | 112.83 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ZEEL (F&O) | 37987576 | 247.15 | 244.14 | 248.06 | 240.37 | 236.51 | 232.68 | 228.88 |

| IIFL | 19179899 | 295.20 | 293.27 | 297.56 | 289.14 | 284.91 | 280.70 | 276.53 |

| TATAMTRDVR | 8909293 | 157.00 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |

| DELTACORP | 7150056 | 237.65 | 236.39 | 240.25 | 232.68 | 228.88 | 225.11 | 221.38 |

| RECLTD (F&O) | 2961601 | 156.30 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |

| LUPIN (F&O) | 2960830 | 968.10 | 961.00 | 968.77 | 953.74 | 946.04 | 938.36 | 930.72 |

| LXCHEM | 2708951 | 568.20 | 564.06 | 570.02 | 558.42 | 552.53 | 546.66 | 540.83 |

| GREAVESCOT | 1922677 | 146.25 | 144.00 | 147.02 | 141.09 | 138.13 | 135.21 | 132.32 |

| IGL (F&O) | 1911692 | 570.80 | 570.02 | 576.00 | 564.34 | 558.42 | 552.53 | 546.66 |

| VISHWARAJ | 1741252 | 140.35 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| VARROC | 1362879 | 303.50 | 301.89 | 306.25 | 297.71 | 293.41 | 289.14 | 284.91 |

| MOL | 1353544 | 120.05 | 118.27 | 121.00 | 115.62 | 112.95 | 110.31 | 107.69 |

| SWSOLAR | 1170640 | 351.45 | 346.89 | 351.56 | 342.42 | 337.81 | 333.23 | 328.68 |

| HEMIPROP | 1121670 | 136.85 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| GSPL | 1068907 | 334.85 | 333.06 | 337.64 | 328.68 | 324.16 | 319.68 | 315.22 |

| NIITLTD | 1027766 | 324.75 | 324.00 | 328.52 | 319.68 | 315.22 | 310.80 | 306.40 |

| ZENTEC | 823421 | 204.10 | 203.06 | 206.64 | 199.62 | 196.10 | 192.61 | 189.16 |

| SEQUENT | 794596 | 227.25 | 225.00 | 228.77 | 221.38 | 217.67 | 214.00 | 210.36 |

| EXXARO | 794113 | 159.10 | 156.25 | 159.39 | 153.22 | 150.14 | 147.09 | 144.07 |

| AWHCL | 714705 | 414.45 | 410.06 | 415.14 | 405.22 | 400.20 | 395.21 | 390.26 |

| SVPGLOB | 610924 | 137.65 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| CHEMPLASTS | 550244 | 555.45 | 552.25 | 558.14 | 546.66 | 540.83 | 535.03 | 529.26 |

| JKLAKSHMI | 532115 | 710.00 | 708.89 | 715.56 | 702.60 | 695.99 | 689.41 | 682.86 |

| MFSL (F&O) | 473774 | 1104.45 | 1097.27 | 1105.56 | 1089.54 | 1081.31 | 1073.10 | 1064.92 |

| XCHANGING | 433650 | 115.30 | 112.89 | 115.56 | 110.31 | 107.69 | 105.12 | 102.57 |