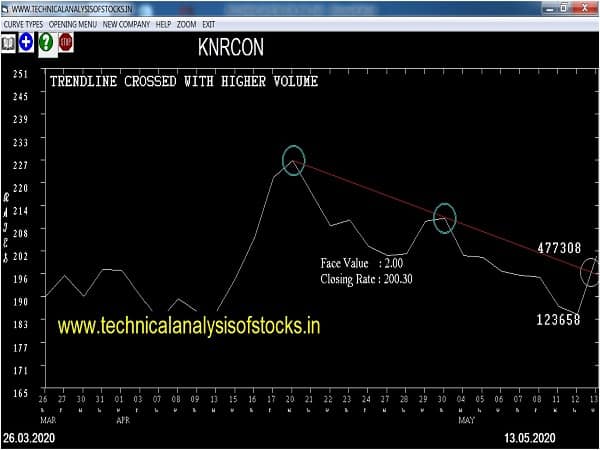

BUY KNRCON (NSE Code) Buy above 203 after cooling period. SIGNAL : TRENDLINE CROSSED WITH HIGHER VOLUME. Stop Loss : 185 Target : 215 (Short term)

HOT BUZZING STOCKS (14.05.2020)

NSE SYMBOL CLOSING RATE

MAANALU 41.50

HSCL 48.70

ZUARIGLOB 41.60

AUBANK 399.15

HIKAL 103.95

IRCTC 1437.10

JUBILANT 428.55

POLYCAB 701.75

TATACOMM 438.10

CREDITACC 402.60

SHANKARA 253.50

ALLCARGO 69.50

EDELWEISS 44.25

SOBHA 205.40

MSTCLTD 98.25

Strategy : INSIDE CANDLES

RAMCOIND Buy @ 119.50 or above

GLENMARK (F&O) Buy @ 339 or above

PVR Buy @ 926 or above

APOLLOHOSP (F&O) Buy @ 1327 or above

CGCL Sell @ 135 or below

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

NIL

Strategy : GARTLEY SIGNAL (W & M Patterns) (INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

FOR THE ATTENTION OF SWING TRADERS

BUY RECOMMENDATION IF THE MARKET IS BULLISH

NIL

SELL RECOMMENDATION IF THE MARKET IS BEARISH

COLPAL (F&O)

DABUR (F&O)

KITEX

PIDILITIND (F&O)

RADICO

RELAXO

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| HEG | 771.00 | 777.02 | 770.06 | 783.61 | 790.62 | 797.66 | 804.74 |

| GRAPHITE | 187.05 | 189.06 | 185.64 | 192.42 | 195.90 | 199.42 | 202.96 |

| ADANITRANS | 200.20 | 203.06 | 199.52 | 206.54 | 210.14 | 213.78 | 217.45 |

| BSOFT | 72.65 | 74.39 | 72.25 | 76.52 | 78.73 | 80.96 | 83.22 |

| PRAJIND | 57.10 | 58.14 | 56.25 | 60.03 | 61.98 | 63.97 | 65.98 |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| AMBUJACEM (F&O) | 183.00 | 182.25 | 185.64 | 178.98 | 175.65 | 172.35 | 169.08 |

| MCDOWELL-N (F&O) | 510.20 | 506.25 | 511.89 | 500.89 | 495.31 | 489.76 | 484.24 |

| CUMMINSIND (F&O) | 362.65 | 361.00 | 365.77 | 356.44 | 351.74 | 347.06 | 342.42 |

| LICHSGFIN (F&O) | 274.50 | 272.25 | 276.39 | 268.27 | 264.19 | 260.15 | 256.13 |

| TANLA | 64.40 | 64.00 | 66.02 | 62.05 | 60.09 | 58.17 | 56.28 |