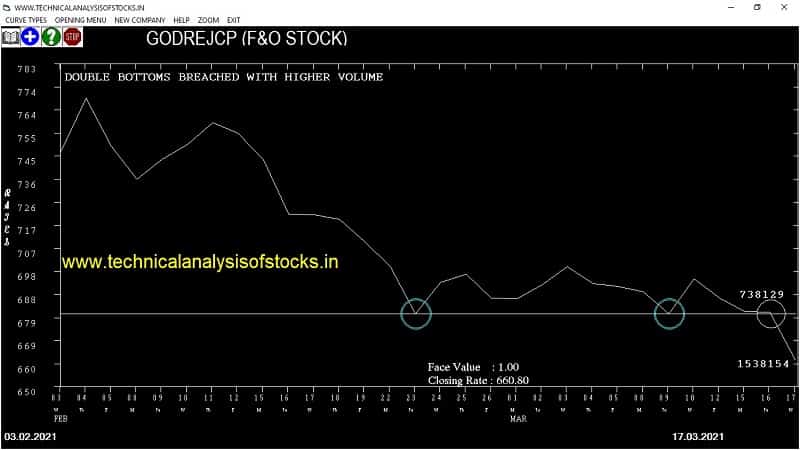

SELL GODREJCP (NSE Symbol) Sell @ 656.65 or Below after cooling period. SIGNAL : DOUBLE BOTTOMS BREACHED WITH HIGHER VOLUME. Stop Loss : 688.70 Target : 631.60 (Short term)

HOT BUZZING STOCKS (18.03.2021)

NSE SYMBOL CLOSING RATE

EMAMIPAP 140.15

HOVS 47.55

SATIN 93.10

AKG 105.30

EDELWEISS 84.35

ONMOBILE 106.40

HINDCOPPER 125.15

XPROINDIA 54.55

GREENPANEL 174.45

RAMKY 80.15

VETO 131.60

WEBELSOLAR 44.70

HLEGLAS 2435.20

JINDALPOLY 825.25

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

NIL

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

|---|---|---|---|---|

| JINDALSTEL (F&O) | 49734 | 309.40 | 308.75 | 0.21 |

| NAUKRI (F&O) | 29065 | 4774.00 | 4761.70 | 0.26 |

| CUMMINSIND (F&O) | 18351 | 844.00 | 839.05 | 0.59 |

| AMBUJACEM (F&O) | 29485 | 283.15 | 280.85 | 0.82 |

| NTPC (F&O) | 59534 | 107.45 | 106.55 | 0.84 |

| CIPLA (F&O) | 55307 | 780.00 | 772.15 | 1.02 |

| L&TFH (F&O) | 31119 | 102.80 | 101.70 | 1.08 |

| RAMCOCEM (F&O) | 14625 | 962.50 | 950.95 | 1.21 |

| TATAMOTORS (F&O) | 315250 | 309.60 | 305.80 | 1.24 |

| GSPL | 15606 | 268.55 | 264.65 | 1.47 |

| INDIACEM | 21781 | 167.50 | 163.20 | 2.63 |

| TATAMTRDVR | 31372 | 133.70 | 130.20 | 2.69 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE |

| BHARTIARTL (F&O) | 110807 | 523.27 | 495.31 | 546.12 | 522.90 | 532.00 |

| TORNTPOWER (F&O) | 60797 | 420.25 | 395.21 | 440.78 | 417.00 | 429.70 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| TATASTEEL (F&O) | 123251 | 702.25 | 735.40 | 676.34 | 704.40 | 702.25 | 0.31 |

| GRASIM (F&O) | 29134 | 1359.77 | 1405.55 | 1323.80 | 1367.10 | 1361.05 | 0.44 |

| HINDZINC | 13373 | 293.27 | 314.90 | 276.53 | 295.10 | 293.70 | 0.47 |

| PIDILITIND (F&O) | 22268 | 1722.25 | 1773.63 | 1681.84 | 1723.55 | 1714.25 | 0.54 |

| WIPRO (F&O) | 131278 | 415.14 | 440.78 | 395.21 | 419.65 | 417.00 | 0.63 |

| HINDPETRO (F&O) | 69045 | 232.56 | 251.89 | 217.67 | 235.90 | 233.40 | 1.06 |

| CHOLAFIN (F&O) | 33871 | 529.00 | 557.86 | 506.50 | 529.60 | 519.50 | 1.91 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

NMDC,4.96%

CUB,6.09%

HINDZINC,7.05%

BALAMINES,10.99%

BEML,12.12%

DBL,16.09%

IMPERFECT PENNANT TRIANGLE STOCKS

(One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

DALBHARAT,0.99%

BHARTIARTL,1.74%

PIDILITIND,2.11%

GODREJIND,2.41%

GATI,2.79%

GRASIM,2.99%

TORNTPOWER,3.05%

MOTHERSUMI,3.79%

MOTILALOFS,4.05%

HINDPETRO,4.32%

UPL,4.43%

NAUKRI,4.67%

M&MFIN,4.72%

AMBUJACEM,4.79%

WIPRO,4.85%

NTPC,4.97%

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

NIL

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

NIL

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

DIVISLAB (F&O)

GPIL

OPTIEMUS

SANDHAR

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

GODREJIND

ICIL

NATCOPHARM

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

BHARTIARTL (F&O)

Higher Level Consolidation

BHARTIARTL (F&O)

CREDITACC

EICHERMOT (F&O)

OIL

RALLIS

Lower Level Consolidation

DABUR (F&O)

GAEL

NCC

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

NIL

GAP DOWN BREAKOUT STOCKS

BPCL (F&O)

SBICARD

TATACOMM

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

NIL

BEARISH ENGULFING

CCL

CGPOWER

NH

SMCGLOBAL

UBL

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

BAFNAPH

BIGBLOC

BEARISH MARUBOZU PATTERN

NIL

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

BECTORFOOD

INDUSTOWER (F&O)

QUICKHEAL

TATACHEM (F&O)

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

DHANI

WSTCSTPAPR

SELL RECOMMENDATION AT HIGHER LEVELS

NIL

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS)

BUY RECOMMENDATION IF THE MARKET IS BULLISH

APTECHT

ASTRAMICRO

BAJFINANCE (F&O)

BPCL (F&O)

CSBBANK

CYIENT

EIHOTEL

HAL

HINDPETRO (F&O)

IBREALEST

INFY (F&O)

JINDALSTEL (F&O)

JMCPROJECT

LALPATHLAB (F&O)

M&M (F&O)

MGL (F&O)

MINDACORP

RAYMOND

SEQUENT

SHOPERSTOP

SRTRANSFIN (F&O)

STARPAPER

SWANENERGY

TATACOFFEE

TATAMOTORS (F&O)

VOLTAS (F&O)

SELL RECOMMENDATION IF THE MARKET IS BEARISH

ASIANPAINT (F&O)

BATAINDIA (F&O)

BFUTILITIE

BRITANNIA (F&O)

BSE

DEN

DIVISLAB (F&O)

GOKEX

IGL (F&O)

INDHOTEL

ISEC

KIRIINDUS

KOPRAN

MIDHANI

MIRZAINT

NLCINDIA

SPENCERS

STAR

VAKRANGEE

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| SUVENPHAR | 479.50 | 484.00 | 478.52 | 489.27 | 494.81 | 500.39 | 506.00 |

| SRTRANSFIN (F&O) | 1321.60 | 1323.14 | 1314.06 | 1331.58 | 1340.72 | 1349.89 | 1359.09 |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| INDIAGLYCO | 466.95 | 462.25 | 467.64 | 457.12 | 451.79 | 446.49 | 441.22 |

| BALAMINES | 1716.80 | 1711.89 | 1722.25 | 1702.41 | 1692.11 | 1681.84 | 1671.60 |

| MCDOWELL-N (F&O) | 537.75 | 534.77 | 540.56 | 529.26 | 523.53 | 517.82 | 512.15 |

| AVANTIFEED | 470.30 | 467.64 | 473.06 | 462.48 | 457.12 | 451.79 | 446.49 |

| MSTCLTD | 318.55 | 315.06 | 319.52 | 310.80 | 306.40 | 302.04 | 297.71 |

| INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| GATI | 3200143 | 111.20 | 112.89 | 110.25 | 115.50 | 118.21 | 120.94 | 123.70 |

| DEEPAKFERT | 2823721 | 242.30 | 244.14 | 240.25 | 247.94 | 251.89 | 255.87 | 259.89 |

| SHARDACROP | 2015620 | 305.40 | 306.25 | 301.89 | 310.49 | 314.90 | 319.36 | 323.84 |

| DALBHARAT | 1167113 | 1558.60 | 1560.25 | 1550.39 | 1569.36 | 1579.27 | 1589.22 | 1599.20 |

| SEQUENT | 1031539 | 232.05 | 232.56 | 228.77 | 236.27 | 240.13 | 244.02 | 247.94 |

| IFGLEXPOR | 986507 | 298.10 | 301.89 | 297.56 | 306.10 | 310.49 | 314.90 | 319.36 |

| APLAPOLLO | 513156 | 1160.60 | 1164.52 | 1156.00 | 1172.48 | 1181.05 | 1189.65 | 1198.29 |

| CENTENKA | 380453 | 277.10 | 280.56 | 276.39 | 284.62 | 288.86 | 293.12 | 297.41 |

| SHAKTIPUMP | 316734 | 543.90 | 546.39 | 540.56 | 551.97 | 557.86 | 563.78 | 569.73 |

| ELGIEQUIP | 283552 | 198.70 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| LUMAXTECH | 240102 | 160.75 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| GMMPFAUDLR | 191206 | 4308.55 | 4323.06 | 4306.64 | 4337.35 | 4353.82 | 4370.33 | 4386.87 |

| INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME | ||||||||

|---|---|---|---|---|---|---|---|---|

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

| TATAMOTORS (F&O) | 47262481 | 305.80 | 301.89 | 306.25 | 297.71 | 293.41 | 289.14 | 284.91 |

| SBIN (F&O) | 33143064 | 368.15 | 365.77 | 370.56 | 361.18 | 356.44 | 351.74 | 347.06 |

| ONGC (F&O) | 31017863 | 109.35 | 107.64 | 110.25 | 105.12 | 102.57 | 100.05 | 97.56 |

| ASHOKLEY (F&O) | 29720642 | 117.15 | 115.56 | 118.27 | 112.95 | 110.31 | 107.69 | 105.12 |

| BPCL (F&O) | 28849799 | 432.05 | 430.56 | 435.77 | 425.60 | 420.46 | 415.35 | 410.27 |

| SBICARD | 23676553 | 978.30 | 976.56 | 984.39 | 969.25 | 961.48 | 953.74 | 946.04 |

| NTPC (F&O) | 18850429 | 106.55 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| CANBK (F&O) | 17552475 | 150.25 | 150.06 | 153.14 | 147.09 | 144.07 | 141.09 | 138.13 |

| IBULHSGFIN (F&O) | 17070297 | 214.80 | 213.89 | 217.56 | 210.36 | 206.74 | 203.16 | 199.62 |

| RBLBANK (F&O) | 16440990 | 223.40 | 221.27 | 225.00 | 217.67 | 214.00 | 210.36 | 206.74 |

| GAIL (F&O) | 15613786 | 138.40 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| COALINDIA (F&O) | 15554810 | 139.85 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| WIPRO (F&O) | 12134812 | 419.65 | 415.14 | 420.25 | 410.27 | 405.22 | 400.20 | 395.21 |

| BEL (F&O) | 11951944 | 133.85 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| ZEEL (F&O) | 11389219 | 203.35 | 203.06 | 206.64 | 199.62 | 196.10 | 192.61 | 189.16 |

| HINDALCO (F&O) | 11028678 | 326.40 | 324.00 | 328.52 | 319.68 | 315.22 | 310.80 | 306.40 |

| TATASTEEL (F&O) | 10540959 | 704.40 | 702.25 | 708.89 | 695.99 | 689.41 | 682.86 | 676.34 |

| NMDC (F&O) | 9254642 | 133.05 | 132.25 | 135.14 | 129.46 | 126.63 | 123.83 | 121.06 |

| HINDPETRO (F&O) | 9097491 | 235.90 | 232.56 | 236.39 | 228.88 | 225.11 | 221.38 | 217.67 |

| RELIANCE (F&O) | 8865521 | 2055.35 | 2047.56 | 2058.89 | 2037.28 | 2026.01 | 2014.77 | 2003.56 |

| L&TFH (F&O) | 8522283 | 101.70 | 100.00 | 102.52 | 97.56 | 95.11 | 92.69 | 90.30 |

| PFC (F&O) | 8175296 | 135.70 | 135.14 | 138.06 | 132.32 | 129.46 | 126.63 | 123.83 |

| ADANIPORTS (F&O) | 8151544 | 688.25 | 682.52 | 689.06 | 676.34 | 669.85 | 663.39 | 656.97 |

| DLF (F&O) | 7754321 | 291.15 | 289.00 | 293.27 | 284.91 | 280.70 | 276.53 | 272.39 |

| SUNPHARMA (F&O) | 7667561 | 584.75 | 582.02 | 588.06 | 576.29 | 570.30 | 564.34 | 558.42 |