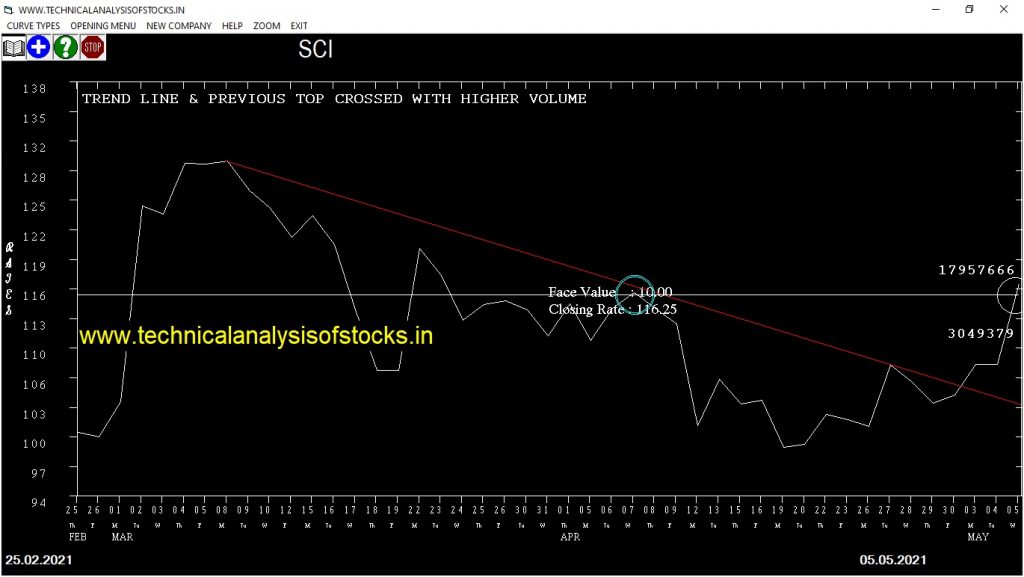

BUY SCI (NSE Symbol) Buy @ 118.25 or Above after cooling period. SIGNAL : TREND LINE & PREVIOUS TOP CROSSED WITH HIGHER VOLUME. Stop Loss : 105.10 Target : 129.30 (Short term)

HOT BUZZING STOCKS (06.05.2021)

NSE SYMBOL CLOSING RATE

SHREYAS 97.85

SILINV 242.90

TIL 216.80

INDRAMEDCO 83.25

DSSL 100.10

DEEPENR 41.20

KOTHARIPRO 77.90

NDTV 69.30

HIKAL 313.95

KILITCH 130.20

JINDALPOLY 788.90

NURECA 1333.35

PGEL 338.15

AGARIND 175.55

IZMO 78.85

VAISHALI 40.00

MAGMA 128.65

NAHARSPING 110.60

CGPOWER 80.35

MAWANASUG 49.75

JSWISPL 53.00

JAIBALAJI 51.95

LYKALABS 43.25

EKC 113.80

FRETAIL 47.75

MOREPENLAB 62.00

FLFL 55.15

Strategy: TODAY’S PENNANT BREAKOUTS

BULLISH PENNANT BREAKOUT OF 15 DAY’S HIGH OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S HIGH | CLOSE | % DIF |

| WOCKPHARMA | 136599 | 533.00 | 534.35 | 0.25 |

| FACT | 14184 | 117.10 | 117.85 | 0.64 |

| ALKEM (F&O) | 62018 | 2856.95 | 2894.45 | 1.30 |

| GRANULES (F&O) | 100789 | 347.00 | 352.45 | 1.55 |

| AEGISCHEM | 12844 | 320.00 | 327.05 | 2.16 |

| SOLARA | 24803 | 1559.00 | 1611.50 | 3.26 |

BEARISH PENNANT BREAKDOWN OF 15 DAY’S LOW OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | 15 DAY’S LOW | CLOSE | % DIF |

| APLLTD (F&O) | 45267 | 973.55 | 955.80 | 1.86 |

Strategy : IMMINENT PENNANT BREAKOUTS (Short term)

1% GREATER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | BUY @ or ABOVE | STOP LOSS | TARGET | CLOSE | TOP OF TALLEST CANDLE | % DIF |

| MINDTREE (F&O) | 34390 | 2173.89 | 2117.06 | 2219.66 | 2166.55 | 2173.80 | -0.33 |

| HERANBA | 11631 | 722.27 | 689.41 | 749.02 | 718.50 | 728.00 | -1.32 |

1% LESSER THAN 15 DAY’S MID VALUE OF FIRST TALLEST CANDLE (FROM CURRENT DAY – 5 DAYS)

| SYMBOL | NO. OF TRADES | SELL @ or BELOW | STOP LOSS | TARGET | CLOSE | BOTTOM OF TALLEST CANDLE | % DIF |

| BALAMINES | 18266 | 2388.77 | 2449.02 | 2341.31 | 2398.60 | 2364.35 | 1.43 |

| MPHASIS (F&O) | 12187 | 1743.06 | 1794.74 | 1702.41 | 1747.15 | 1715.15 | 1.83 |

Strategy : PENNANT TRIANGLE PATTERN (Algorithmic/Intraday/Short term)

PERFECT PENNANT TRIANGLE STOCKS (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

SYMBOL,% DIF

TECHM (F&O),2.83%

RAMCOCEM (F&O),6.75%

TVSMOTOR (F&O),9.96%

SUDARSCHEM,14.57%

IMPERFECT PENNANT TRIANGLE STOCKS (One/Two violations) (In the increasing order of closeness to the top of the first tallest candlestick from the current day – 5 Days)

SYMBOL,% DIF

MINDTREE (F&O),0.33%

HERANBA,1.32%

LICHSGFIN (F&O),1.66%

DRREDDY (F&O),2.04%

NAVINFLUOR (F&O),2.51%

GLENMARK (F&O),2.57%

EPL,2.64%

GUFICBIO,2.93%

MPHASIS (F&O),3.36%

SHILPAMED,3.41%

JSLHISAR,3.48%

SEQUENT,3.91%

CEATLTD,4.67%

ACC (F&O),4.84%

Strategy : TRIANGLE PATTERN (Intraday/Short term)

NIL

Strategy : INSIDE CANDLES(Intraday/Short term)

MTARTECH Sell @ 916 or Below

HEROMOTOCO (F&O) Sell @ 2767 or Below

Strategy : SPINNING TOPS (Short Term)

(Doji Candlestick pattern near minor Top or Bottom)

BSOFT Buy @ 248.05 or Above

AEGISCHEM Sell @ 324 or Below

Strategy : NR4/NR7 BREAKOUT (EITHER WAY INTRADAY)

PREVIOUS 3 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

AMARAJABAT (F&O)

ASALCBR

BHARTIARTL (F&O)

HEROMOTOCO (F&O)

KAJARIACER

KPRMILL

KRBL

LAOPALA,

SUNTV (F&O)

SUPPETRO

PREVIOUS 6 TRADING DAYS CANDLE HEIGHT SHRINKING STOCKS

APCOTEXIND

BFINVEST

CLNINDIA

OFSS

Strategy : CONSOLIDATING STOCKS (Trade on Day sentiment)

Closing Level Consolidation

BAJAJ-AUTO (F&O)

CANTABIL

COLPAL (F&O)

GUJGASLTD (F&O)

MAJESCO

Higher Level Consolidation

CANTABIL

COLPAL (F&O)

LTI (F&O)

Lower Level Consolidation

APLAPOLLO

BAJAJ-AUTO (F&O)

CANTABIL

COFORGE (F&O)

GIPCL

GRANULES (F&O)

INDUSTOWER (F&O)

JSLHISAR

LTI (F&O)

MAJESCO

MPHASIS (F&O)

NAM-INDIA (F&O)

SCHNEIDER

SUVENPHAR

Strategy : BREAKOUT STOCKS WITH GAPS

GAP UP BREAKOUT STOCKS

GESHIP

HIKAL

MAGMA

ONGC (F&O)

GAP DOWN BREAKOUT STOCKS

EKC

Strategy : ENGULFING STOCKS

BULLISH ENGULFING

NIL

BEARISH ENGULFING

NIL

Strategy : MARUBOZU STOCKS

BULLISH MARUBOZU PATTERN

DSSL

HIKAL

BEARISH MARUBOZU PATTERN

EKC

Strategy : BELLHOLD STOCKS

BULLISH BELLHOLD PATTERN

NIL

BEARISH BELLHOLD PATTERN

PANACEABIO

Strategy : GARTLEY SIGNAL(W & M Patterns)(INTRADAY )

BUY RECOMMENDATION AT LOWER LEVELS

NIL

SELL RECOMMENDATION AT HIGHER LEVELS

DHAMPURSUG

EIDPARRY

INDRAMEDCO

Strategy : Swing Trading (FOR THE ATTENTION OF SWING TRADERS )

BUY RECOMMENDATION IF THE MARKET IS BULLISH

AUROPHARMA (F&O)

BANCOINDIA

CANFINHOME

COFORGE (F&O)

DCAL

GAIL (F&O)

GATI

HEIDELBERG

ISEC

JSLHISAR

KEC

MGL (F&O)

MPHASIS (F&O)

NTPC (F&O)

PFIZER (F&O)

PPL

TNPL

SELL RECOMMENDATION IF THE MARKET IS BEARISH

BRITANNIA (F&O)

COLPAL (F&O)

GABRIEL

GODREJPROP (F&O)

GRSE

HCLTECH (F&O)

HDFC (F&O)

ITC (F&O)

L&TFH (F&O)

MIDHANI

MUNJALAU

PFC (F&O)

RECLTD (F&O)

SYNGENE

TECHM (F&O)

TITAN (F&O)

| STOCKS TO BUY FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | BUY AT / ABOVE | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| ITC (F&O) | 201.40 | 203.06 | 199.52 | 206.54 | 210.14 | 213.78 | 217.45 |

| INFY (F&O) | 1341.50 | 1350.56 | 1341.39 | 1359.09 | 1368.32 | 1377.58 | 1386.87 |

| BAJAJ-AUTO (F&O) | 3843.80 | 3844.00 | 3828.52 | 3857.59 | 3873.12 | 3888.70 | 3904.30 |

| AMBUJACEM (F&O) | 311.45 | 315.06 | 310.64 | 319.36 | 323.84 | 328.35 | 332.90 |

| CHOLAFIN (F&O) | 558.60 | 564.06 | 558.14 | 569.73 | 575.71 | 581.72 | 587.77 |

| STOCKS TO SELL FOR INTRADAY | |||||||

|---|---|---|---|---|---|---|---|

| SCRIP NAME (NSE CODE) | PREVIOUS CLOSE | SELL AT / BELOW | STOP LOSS | TARGET 1 | TARGET 2 | TARGET 3 | TARGET 4 |

| TRITURBINE | 101.50 | 100.00 | 102.52 | 97.56 | 95.11 | 92.69 | 90.30 |

| NRBBEARING | 106.20 | 105.06 | 107.64 | 102.57 | 100.05 | 97.56 | 95.11 |

| VOLTAS (F&O) | 971.45 | 968.77 | 976.56 | 961.48 | 953.74 | 946.04 | 938.36 |

| HUHTAMAKI | 283.55 | 280.56 | 284.77 | 276.53 | 272.39 | 268.27 | 264.19 |

| DEEPAKFERT | 261.30 | 260.02 | 264.06 | 256.13 | 252.14 | 248.19 | 244.26 |

INTRADAY BUY RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | BUY ABOVE | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| VEDL (F&O) | 83074283 | 264.30 | 268.14 | 264.06 | 272.11 | 276.25 | 280.42 | 284.62 |

| CANBK (F&O) | 22404765 | 145.60 | 147.02 | 144.00 | 149.99 | 153.06 | 156.17 | 159.31 |

| BEL (F&O) | 17272091 | 137.85 | 138.06 | 135.14 | 140.95 | 143.93 | 146.94 | 149.99 |

| UPL (F&O) | 11454883 | 640.70 | 643.89 | 637.56 | 649.92 | 656.31 | 662.73 | 669.18 |

| AXISBANK (F&O) | 11155033 | 717.20 | 722.27 | 715.56 | 728.64 | 735.40 | 742.19 | 749.02 |

| FORTIS | 7484763 | 221.00 | 221.27 | 217.56 | 224.89 | 228.65 | 232.45 | 236.27 |

| PRAJIND | 7435748 | 254.80 | 256.00 | 252.02 | 259.89 | 263.93 | 268.01 | 272.11 |

| FSL | 6948485 | 127.60 | 129.39 | 126.56 | 132.18 | 135.07 | 137.99 | 140.95 |

| WOCKPHARMA | 6853772 | 534.35 | 534.77 | 529.00 | 540.29 | 546.12 | 551.97 | 557.86 |

| BIOCON (F&O) | 6252361 | 381.30 | 385.14 | 380.25 | 389.87 | 394.82 | 399.80 | 404.81 |

| INDUSINDBK (F&O) | 5975741 | 931.15 | 937.89 | 930.25 | 945.09 | 952.79 | 960.52 | 968.28 |

| GLENMARK (F&O) | 4679850 | 572.90 | 576.00 | 570.02 | 581.72 | 587.77 | 593.84 | 599.95 |

| AUBANK (F&O) | 4578774 | 942.05 | 945.56 | 937.89 | 952.79 | 960.52 | 968.28 | 976.07 |

| SUNTV (F&O) | 3130867 | 500.65 | 506.25 | 500.64 | 511.63 | 517.30 | 523.00 | 528.74 |

| MCDOWELL-N (F&O) | 2649970 | 542.15 | 546.39 | 540.56 | 551.97 | 557.86 | 563.78 | 569.73 |

| SHALBY | 2548151 | 138.45 | 141.02 | 138.06 | 143.93 | 146.94 | 149.99 | 153.06 |

| KOTAKBANK (F&O) | 2411643 | 1770.75 | 1774.52 | 1764.00 | 1784.17 | 1794.74 | 1805.35 | 1815.98 |

| TRIVENI | 2032584 | 132.90 | 135.14 | 132.25 | 137.99 | 140.95 | 143.93 | 146.94 |

| DCAL | 1801917 | 162.50 | 162.56 | 159.39 | 165.68 | 168.92 | 172.18 | 175.47 |

| APOLLOHOSP (F&O) | 1679977 | 3332.90 | 3335.06 | 3320.64 | 3347.84 | 3362.32 | 3376.83 | 3391.37 |

| AARTIIND (F&O) | 1605488 | 1715.70 | 1722.25 | 1711.89 | 1731.77 | 1742.19 | 1752.64 | 1763.12 |

| EASEMYTRIP | 1475156 | 196.95 | 199.52 | 196.00 | 202.96 | 206.54 | 210.14 | 213.78 |

| GATI | 1403761 | 105.15 | 107.64 | 105.06 | 110.19 | 112.83 | 115.50 | 118.21 |

| INDHOTEL | 1369097 | 111.75 | 112.89 | 110.25 | 115.50 | 118.21 | 120.94 | 123.70 |

| KIRLFER | 1351439 | 219.15 | 221.27 | 217.56 | 224.89 | 228.65 | 232.45 | 236.27 |

INTRADAY SELL RECOMMENDATIONS IN THE DESCENDING ORDER OF TRADED VOLUME

| SYMBOL | VOLUME | CLOSING PRICE | SELL BELOW | STOP LOSS | TARGET1 | TARGET2 | TARGET3 | TARGET4 |

|---|---|---|---|---|---|---|---|---|

| ADANIPORTS (F&O) | 29426971 | 738.10 | 735.77 | 742.56 | 729.36 | 722.63 | 715.92 | 709.25 |

| BANDHANBNK (F&O) | 9773654 | 311.25 | 310.64 | 315.06 | 306.40 | 302.04 | 297.71 | 293.41 |

| GREAVESCOT | 3441719 | 138.25 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| ABFRL | 2206027 | 172.95 | 172.27 | 175.56 | 169.08 | 165.85 | 162.64 | 159.47 |

| APLLTD (F&O) | 1614773 | 955.80 | 953.27 | 961.00 | 946.04 | 938.36 | 930.72 | 923.10 |

| EKC | 1528637 | 113.80 | 112.89 | 115.56 | 110.31 | 107.69 | 105.12 | 102.57 |

| IRCTC (F&O) | 1215718 | 1723.65 | 1722.25 | 1732.64 | 1712.75 | 1702.41 | 1692.11 | 1681.84 |

| GODREJPROP (F&O) | 1105279 | 1223.40 | 1216.27 | 1225.00 | 1208.17 | 1199.49 | 1190.85 | 1182.23 |

| JUSTDIAL | 890033 | 816.25 | 812.25 | 819.39 | 805.54 | 798.46 | 791.41 | 784.39 |

| PANACEABIO | 716637 | 319.95 | 319.52 | 324.00 | 315.22 | 310.80 | 306.40 | 302.04 |

| DCMSHRIRAM | 554661 | 702.50 | 702.25 | 708.89 | 695.99 | 689.41 | 682.86 | 676.34 |

| BORORENEW | 520439 | 246.40 | 244.14 | 248.06 | 240.37 | 236.51 | 232.68 | 228.88 |

| CYIENT | 425977 | 763.65 | 763.14 | 770.06 | 756.63 | 749.77 | 742.93 | 736.13 |

| STLTECH | 365388 | 226.70 | 225.00 | 228.77 | 221.38 | 217.67 | 214.00 | 210.36 |

| ICIL | 333310 | 138.20 | 138.06 | 141.02 | 135.21 | 132.32 | 129.46 | 126.63 |

| KALPATPOWR | 275385 | 350.50 | 346.89 | 351.56 | 342.42 | 337.81 | 333.23 | 328.68 |

| POLYMED | 229902 | 975.85 | 968.77 | 976.56 | 961.48 | 953.74 | 946.04 | 938.36 |

| SIEMENS (F&O) | 224128 | 1836.45 | 1827.56 | 1838.27 | 1817.80 | 1807.15 | 1796.54 | 1785.96 |

| BALAMINES | 187365 | 2398.60 | 2388.77 | 2401.00 | 2377.75 | 2365.57 | 2353.43 | 2341.31 |

| DFMFOODS | 166340 | 337.90 | 337.64 | 342.25 | 333.23 | 328.68 | 324.16 | 319.68 |