Stocks to Buy now in Bse Nse from 07.02.2022

Shares to buy now tips are based on technical analysis of stocks performed using our software StocktechTM and for positional trading as short or long term investments. All our Stock to buy tips are supported with Technical Patterns and indicators which gives you more freedom to make your decision for profitable trading of stocks in Nse. Become a technical analyst on your own by using our Stock charting Software StocktechTM.

Shares to Buy Tips for Short Term or Long Term Investment

Strategy for all investments: Follow Bottom Up approach which means buy only on declines. Do not buy on up move. Buy only small lots. For example : If you have money to buy 100 stocks buy only 50. Buy next 50 after a decent fall. Don't be over enthusiastic to buy. Hesitate to buy. Keep strict stop loss which means do not buy at that level if you have not bought already. If you have bought already book loss and get out of the stock.

Stocks to Buy now in India February 2022

Stock to Buy 1 : LUXIND (NSE Code) Signal : Bullish pennant break out with higher volume. Buy Above : 3066.40 Stop Loss : 2999.05 Target : 3120.45 (Short term)

Share to Buy 2 : INDOSTAR (NSE Code) Signal : Bullish pennant break out, double tops crossed with higher volume. Buy Above : 260 Stop Loss : 240.40 Target : 276.25 (Short term)

Shares to Buy 3 : CHOLAFIN (NSE Code) Signal : Bullish break out after consolidation near minor top with higher volume. Buy Above : 676 Stop Loss : 644.20 Target : 701.90 (Short term)

Stock to Buy 4 : CARBORUNIV (NSE Code) Signal : Bullish break out after consolidation near minor bottom with higher volume. Buy Above : 907.50 Stop Loss : 870.70 Target : 937.40 (Short term)

Stock to Buy 5 : ASHAPURMIN (NSE Code) Signal : Bullish break out after consolidation near minor bottom with higher volume. Buy Above : 121 Stop Loss : 107.70 Target : 132.20 (Short term)

ADVERTISEMENT

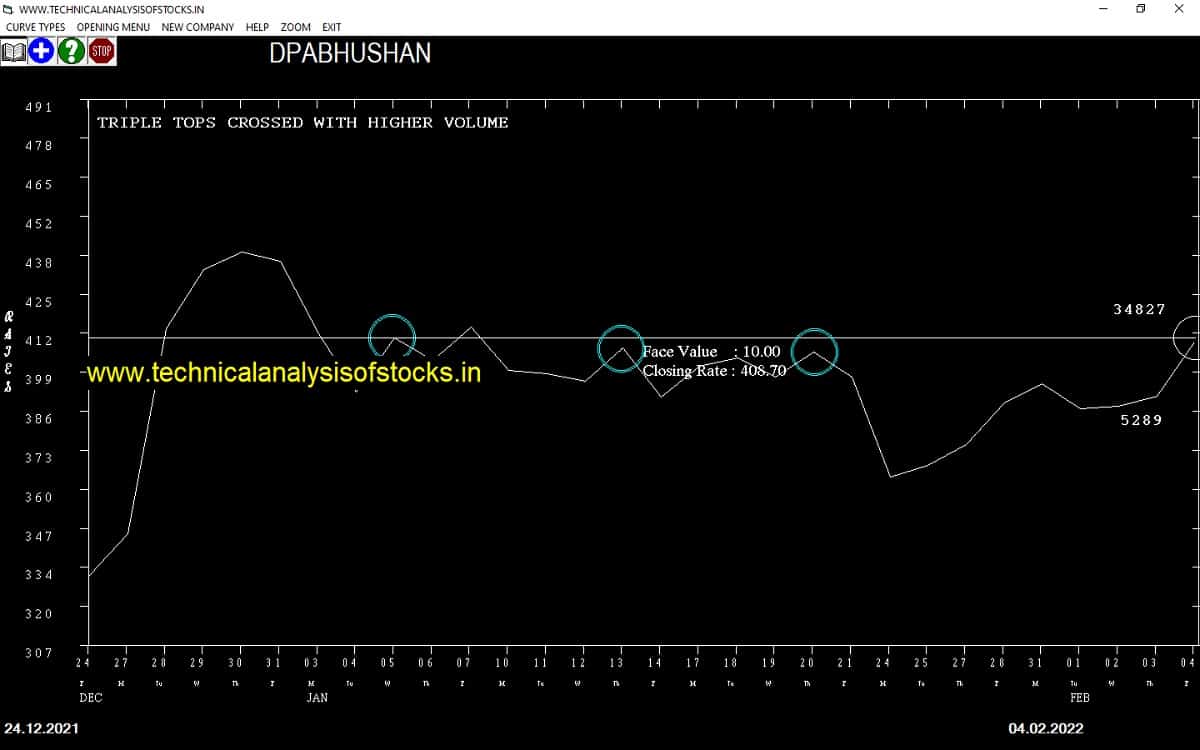

Stock to Buy 6 : DPABHUSHAN (NSE Code) Signal : Triple tops crossed with higher volume. Buy Above : 410 Stop Loss : 385.30 Target : 430.35 (Short term)

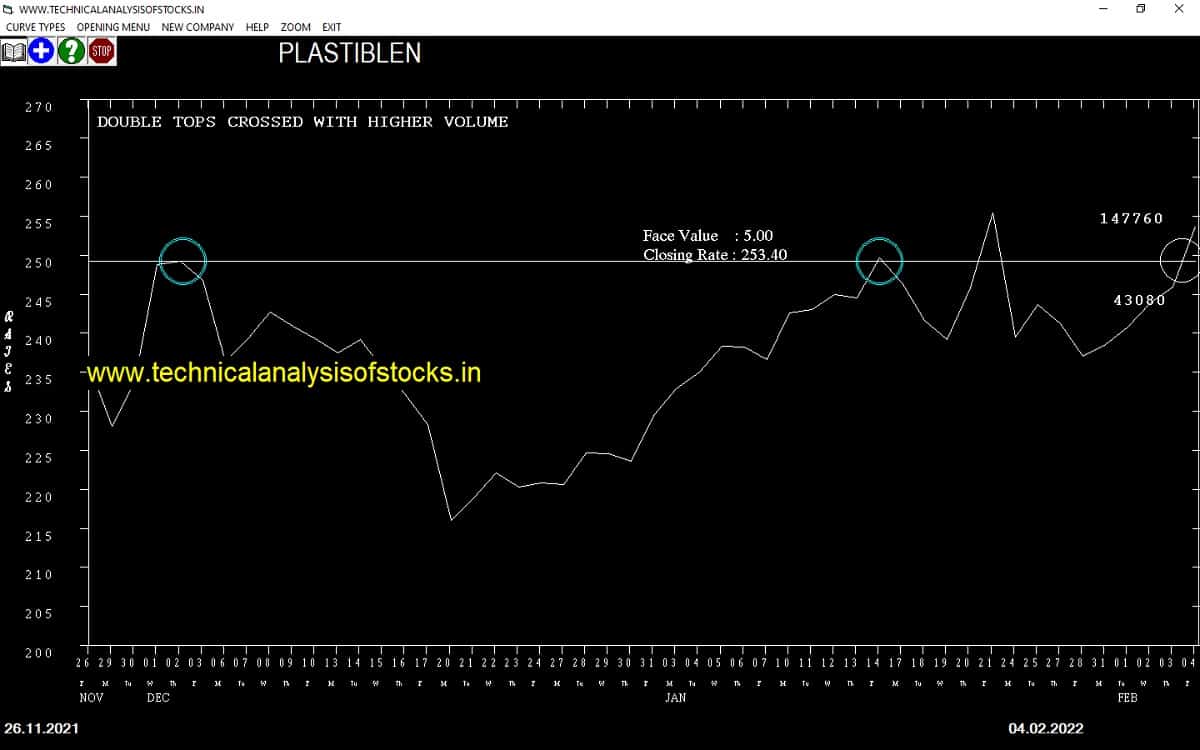

Stock to Buy 7 : PLASTIBLEN (NSE Code) Signal : Double tops crossed with higher volume. Buy Above : 256 Stop Loss : 236.50 Target : 272.10 (Short term)

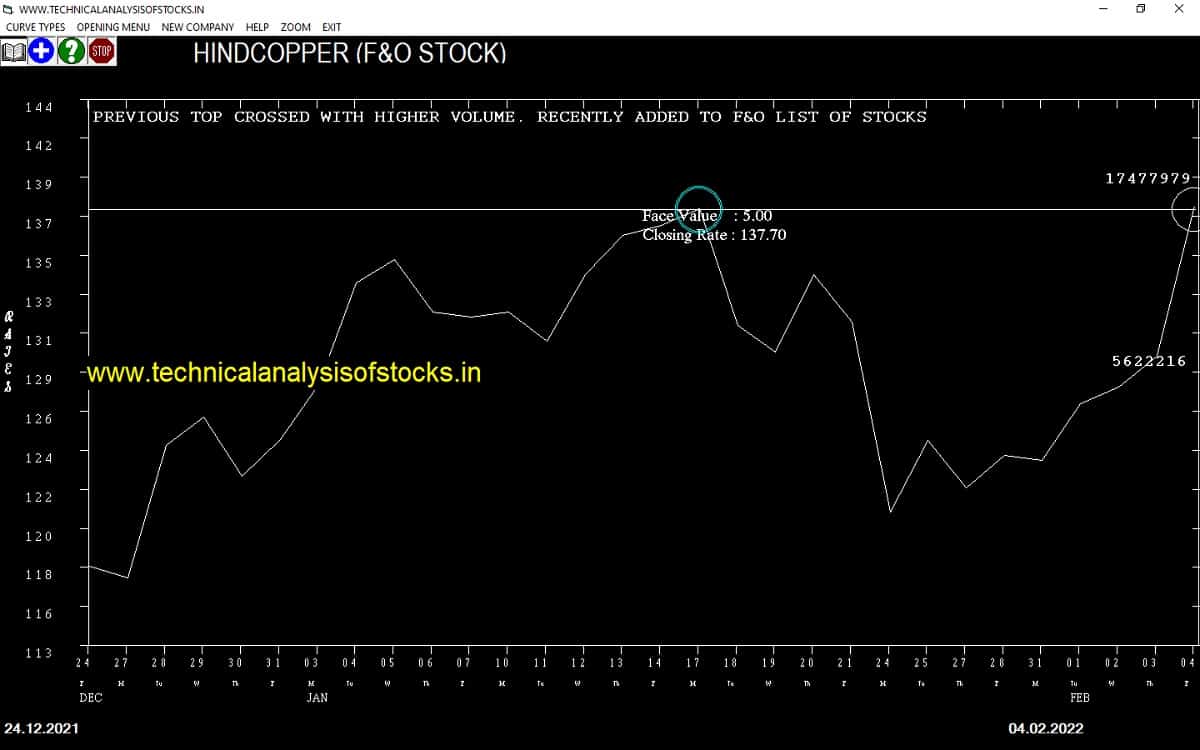

Stock to Buy 8 : HINDCOPPER (NSE Code) Signal : Previous top crossed with higher volume. Recently added to F&O list of stocks. Buy Above : 138.05 Stop Loss : 123.80 Target :150 (Short term)

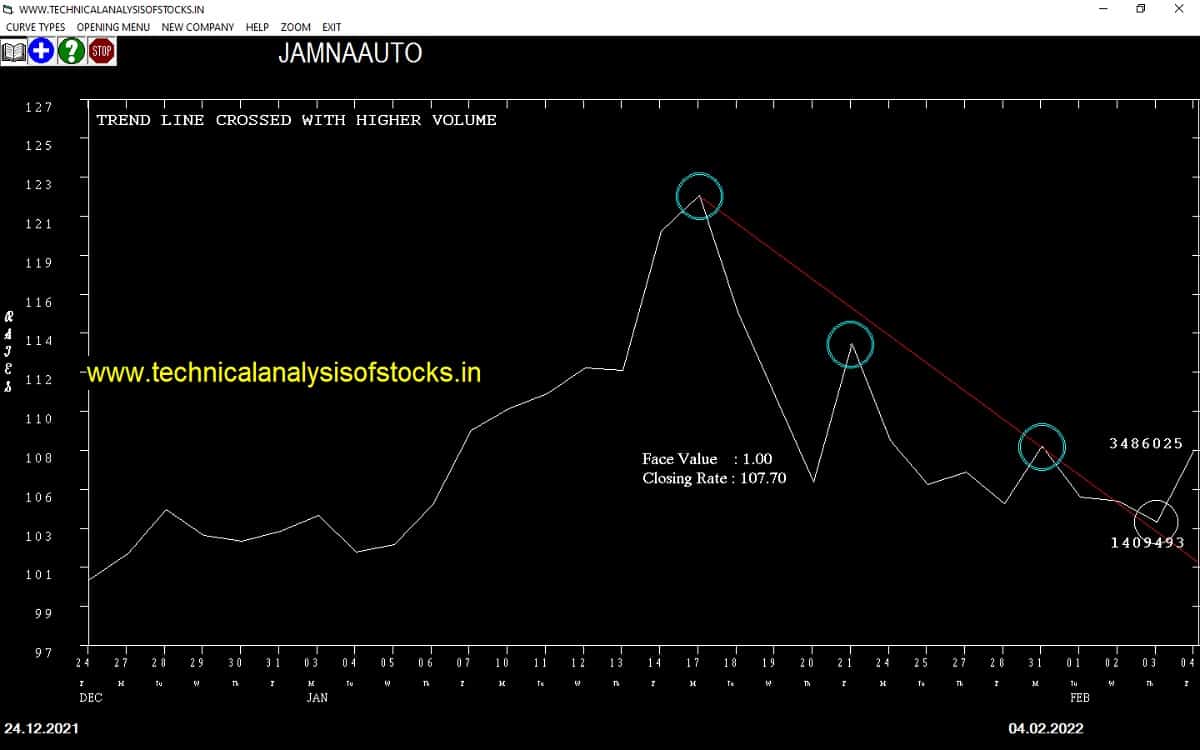

Stock to Buy 9 : JAMNAAUTO (NSE Code) Signal : Trend line crossed with higher volume. Buy Above : 110.25 Stop Loss : 97.55 Target : 120.95 (Short term)

Stock to Buy 10 : EQUITAS (NSE Code) Signal : Bullish pennant break out expected shortly. Buy Above : 115.55 Stop Loss : 102.55 Target : 126.50 (Short term)

Subscribe for Daily and Weekly Recommendations by Mail

Open Low Brokerage Demat Account

Advertisement

Best Trading Strategies for Short or Long Term investments in Stock market

o Strictly adhere to Stop loss.

o Before entering in to trade analyse stocks on the basis of Technical indicators like moving average, Trend line, Trend Channel Patterns, Engulfing, doji, Breakout, Oscillator etc and don't Trade against the trend.

o When people are selling be a buyer. When people are buying be a seller.

o Avoid purchase of stocks when market value of that stock crash.

o Stop loss & Exit to be decided before entering in to the trade.

o Do not have any sentimental attachment with any stock.

o Periodic Profit booking to be done by selling and re-purchase of stocks.

o Do not over trade. Trade only up to 50 % of your Trading capital.

o Do not trade on the basis of rumours.

o It is better to follow Monthly stop loss and stop loss or trade.

o Do not keep all your stock holdings in same sector,distribute your investment to various sectors ie. Diversification of investment to be done.

o Do not invest more than 10% value of your Trading capital in any single stock.

o Buy the stocks whenever there is some bad news and sell the stocks whenever there is good news.

Stock News for the week

o Technical View: Nifty weekly forms a Bullish Candlestick pattern near recovery

o Technical View: Nifty Daily recovery becoming week. Recovery withdrawal symptoms visible

o LIC may outgrow RIL with $272-billion market cap after listing

o Supertech twin tower demolition case: SC directs builder to refund homebuyers by Feb 28

o Gold investment platform Jar raises $32 million led by Tiger Global

o Mahindra XUV300 electric spied ahead of debut this year

o Twitter working on feature that allows users to write long-form articles

o Rupee gains 11 paise to 74.71 against US dollar in early trade

o KPIT Technologies Q3 net zooms 64% to Rs 70.3 crore

o Alembic Pharma gets tentative USFDA nod for fesoterodine fumarate extended-release tablets

o 1486 union laws repealed to make it easier for businesses

o FM Sitharaman talks about 'green bonds' for 'green infrastructure'

o Railways to develop new products for small farmers, MSMEs: Nirmala Sitharaman

o Cases worth Rs 1.48 lakh crore rescued under IBC; Rs 52,000 crore sent for liquidation

o Sun Pharma Q3 profit rises 11% on year to Rs 2,058.80 crore

o Adani Total Gas to invest Rs 20,000 crore in city gas

o Power sector workers to hold nationwide protest on February 1

o Maharashtra govt nod for wine sale in supermarkets unfortunate: decision taken for financial gains: Hazare

o Government to soon allow the retrofitting of CNG kits in BS-VI vehicles